App Store Policy Changes 2026: The Builder’s Guide

The App Store policy changes 2026 are no longer hypotheticals—they’re live realities you have to design around. Apple’s EU model now centers the Core Technology Commission (CTC), introduces a two‑tier Store Services fee, and formalizes broader external linking. If you run growth or product for a subscription app, a UGC network with boosts, or a premium productivity tool, this isn’t just compliance theater. It’s your gross margin, your funnel, and your roadmap for the next four quarters.

What actually changed on January 1, 2026

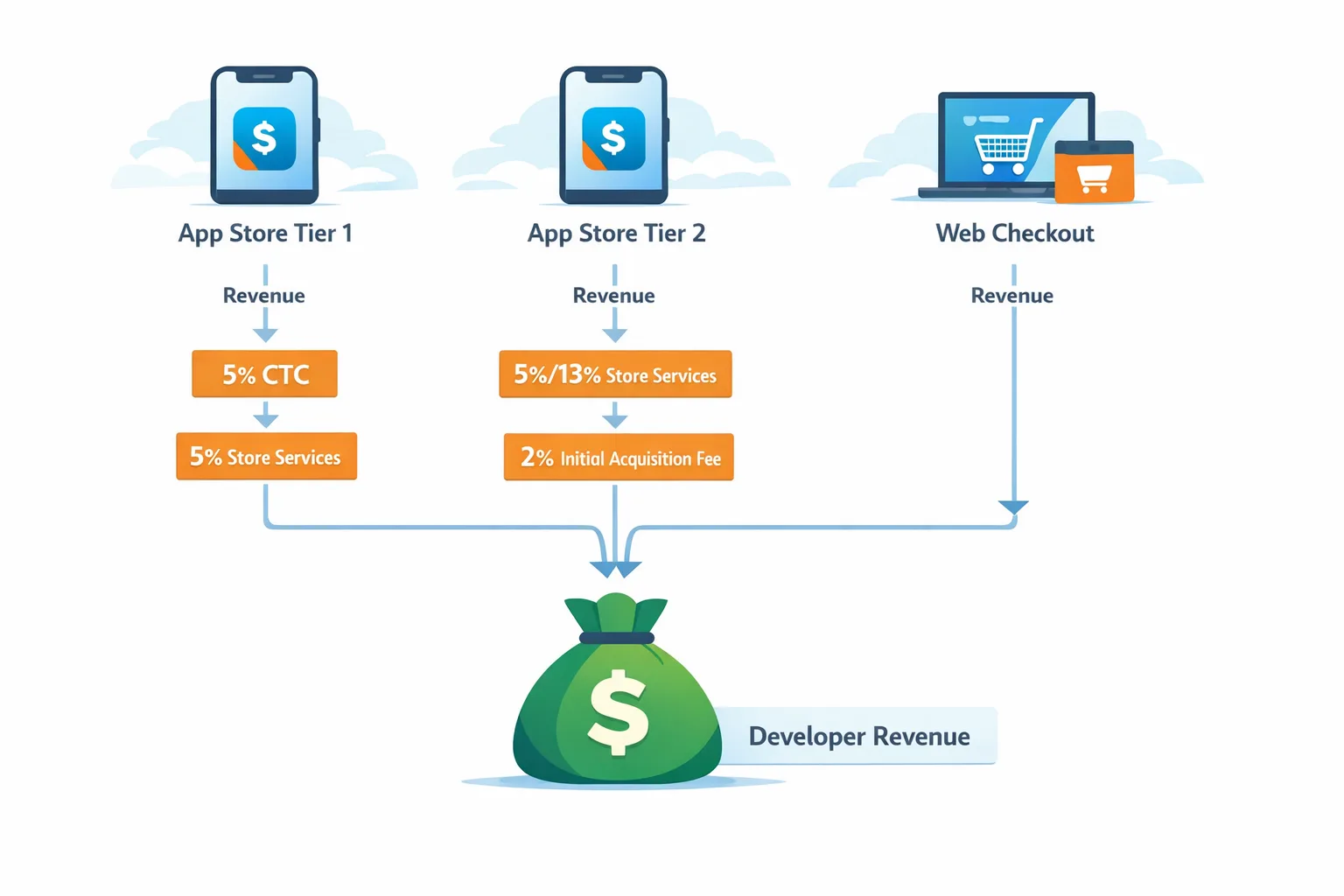

Here’s the short version. Apple’s moving EU distribution to a single business model in 2026 that replaces the prior per‑install Core Technology Fee (CTF) with a percentage‑based Core Technology Commission. The CTC applies to sales of digital goods or services usable in an app, whether you distribute via the App Store, alternative marketplaces, or web distribution. External linking is allowed broadly, including actionable links inside your app, and you choose one of two Store Services tiers for the App Store side of your business.

The big building blocks you must internalize:

- Core Technology Commission (CTC): 5% on eligible digital sales connected to your app. Apple describes renewals and re‑installs as continuing the CTC obligation in subsequent 12‑month periods from install; plan your LTV math accordingly.

- Store Services fee: choose Tier 1 (5%) for a leaner set of App Store services, or Tier 2 (13%, or 10% for Small Business Program and tenured subs) for the full distribution and merchandising toolkit.

- Initial acquisition fee: 2% on first‑time acquisitions under the new terms. Think of it as a one‑time tax on new customers; model it in CAC, not in ongoing take rate.

For teams that adopted the EU alternative business terms last year, you may have run with a mix of the old CTF and the new pieces. As of 2026, align your finance model to CTC‑first economics and treat the old per‑install logic as legacy cleanup.

App Store policy changes 2026: how the new fees stack up (with example math)

Let’s get practical and run scenarios. Assume a €10 monthly subscription. We’ll ignore VAT for simplicity and focus on platform economics. You’re choosing between two levers: where the purchase happens (App Store vs. external checkout you promote in‑app) and which Store Services tier you pick for your App Store presence.

Scenario A: All purchases via App Store, Tier 2

You use native in‑app purchases, want full discovery/merchandising, and accept the higher service fee. Your cost basis is the Tier 2 Store Services percentage on in‑app revenue (13% standard; 10% for Small Business Program or subscriptions after the first year). There’s no CTC on native App Store IAP because the Store Services fee already covers Apple’s economics on that purchase path.

Effective Apple take on a €10 renewal: ~€1.30 at 13% (or €1.00 if you qualify for 10%). No 2% acquisition fee on renewals; the 2% is about first‑time acquisition.

Scenario B: Majority web checkout, in‑app promotion + Tier 1

You steer users to your site from the EU App Store build using allowed, actionable links and run checkout with your PSP (Stripe, Adyen, etc.). In the new model, Apple’s cut for those web purchases involves the 5% CTC, and your App Store presence uses Tier 1 (5%). The 2% initial acquisition fee hits on first conversion; after that, ongoing renewals on web are subject to the CTC (renewing each 12‑month install window).

Effective Apple take on a €10 renewal purchased on the web after an in‑app promotion: €0.50 for the CTC. There’s no Store Services percentage applied to a web renewal, but remember you’re still paying 5% on any App Store transactions that do occur under Tier 1. On first purchase, add the 2% initial acquisition cost to your CAC math.

Scenario C: Mixed funnel, Tier 2 + web promotions

This is where real teams usually land: native IAP for convenience, but clear offers for lower‑price annuals or bundles on the web. Here, your App Store IAP renewals carry the Tier 2 percentage, and web renewals influenced by in‑app promotion incur the 5% CTC. First‑time conversions influenced by the app add the 2% acquisition fee.

The blended effective rate depends on your channel mix. If half your renewals are web and half are native IAP, and your Tier 2 rate is 13%, your blended Apple economics are roughly 9% ((13% + 5%) / 2) across renewals before payment processing and taxes. That’s often a material uplift versus last year’s per‑install fee regime for high‑retention apps.

Which tier should you pick?

Ask one question: how much marginal revenue does Apple’s merchandising actually drive for you? Tier 2 buys exposure (search curation, featuring, personalization), auto‑updates, and the “all the lights stay on” version of App Store distribution. If App Store discovery contributes double‑digit percentages of high‑LTV customers, Tier 2 is usually worth it. If your acquisition is primarily brand‑led, performance‑led, or content‑led off‑store, Tier 1 plus aggressive web offers typically wins.

Here’s the thing: Tier decisions aren’t permanent strategy. You can pilot Tier 1 in one EU storefront cluster for 60 days with a web‑first funnel, then compare ARPU, churn, and net cash versus a Tier 2 control. Treat it like any other GTM experiment, not a philosophical stance.

A 7‑step framework to choose your EU monetization plan

- Map your EU install sources. Split organic App Store discovery from brand/direct and paid media. If App Store organic is under 20% of revenue‑weighted installs, Tier 1 is the default starting point.

- Rebuild your revenue model with CTC. Add a 5% platform line to all web renewals influenced by in‑app promotions. Model CTC renewals in 12‑month install windows, not calendar years.

- Price for the fee mix. If you go web‑heavy, consider passing 1–2% of savings into annual plans to lift take‑rate and retention.

- Treat the 2% initial acquisition fee as CAC. Don’t bake it into renewal margin; put it in your payback model and adjust allowable CPA.

- Decide on Tier 1 vs Tier 2 per app, not per company. Your utility app with strong keyword demand may need Tier 2; your media subscription likely doesn’t.

- Implement compliant in‑app promotions. Use clear copy, test placement, and measure link engagement like any other growth surface. Keep support/refunds flows buttoned up.

- Close the loop with data. Attribute web conversions influenced by the app via clean server‑side events and receipts. Your finance and growth teams should reconcile CTC‑eligible revenue monthly.

Gotchas and edge cases you should plan for

CTC renewals: Apple frames CTC as renewing for additional 12‑month periods after installs, including re‑installs and restores. Translation: don’t assume CTC disappears if a user churns and returns quickly. Your CRM should tag install cohorts and forecast CTC exposure accordingly.

Small Business Program: If you qualify, Tier 2 can effectively drop to 10% on subs after year one, which narrows the gap with Tier 1 + web. Run the math before defaulting to Tier 1.

Multiple distribution channels: The unified model extends CTC beyond the App Store to alternative marketplaces and web distribution where the purchase is for goods usable in your app. Your finance stack needs to recognize where revenue is “App‑usable” and therefore CTC‑eligible, not just where the transaction happened.

UX debt: With warnings and mandated text relaxing, it’s tempting to push aggressive steering screens. Resist. Treat in‑app promos like your best lifecycle messaging—value‑led, not adversarial. Misdirection here creates legal and trust debt.

People also ask

Do I still pay Apple if I use Stripe or Adyen for checkout?

Yes—under the 2026 EU model, Apple applies a 5% Core Technology Commission to eligible digital purchases influenced by in‑app promotions and usable in your app. Your PSP fees are in addition to that.

Is the Core Technology Fee gone?

For the EU, Apple’s unifying around the Core Technology Commission in 2026. If you were still seeing per‑install logic in 2025 under the alternative terms, treat that as transitional. Your forward model should be percentage‑based.

Can I avoid Tier 2 entirely?

Absolutely—Tier 1 exists for that. You’ll give up certain discovery and merchandising features and accept manual update flows, but many brands are fine with that trade.

Does this affect the UK?

This specific EU model is keyed to EU storefronts and DMA compliance. If you sell in the UK, continue to review local terms separately; don’t assume EU rules automatically apply elsewhere.

How this interacts with Google Play’s January 28 deadline

While you’re re‑tooling for Apple’s EU terms, Android has a U.S. compliance clock. Google’s Play policy update requires enrollment by January 28, 2026 if you plan to keep using alternative billing or link users to external content for purchases. If Android revenue in the U.S. is material, you need engineering and legal hands on this now.

We broke down that timeline and ship‑list here: Google Play External Links: Your Jan 28 Plan and its tactical companion The Jan 28 Playbook. If you’re juggling both platforms, sequence your releases so reviewers aren’t blocking your experiment windows.

Implementation checklist (copy/paste this to your tracker)

- Finance: Update EU margin models to include 5% CTC on web renewals influenced by in‑app promotions; add 2% acquisition fee to CAC.

- Product: Decide Tier 1 vs Tier 2 per app. Document rationale and success metrics. Set a 60‑day test plan if unsure.

- Engineering: Build an in‑app promotion surface with flexible copy, clear price disclosure, and deep link to your web checkout. Instrument server‑side events for attribution and CTC reconciliation.

- Payments: Confirm PSP SCA/PSD2 readiness, configure EU tax/VAT, and set receipt tooling to tag App‑usable purchases.

- Legal: Review link copy for DMA compliance and consumer protection; ensure refund and customer support policies are front‑and‑center.

- Analytics: Create dashboards for App Store IAP vs web revenue, CTC exposure by cohort, and Tier‑specific performance.

- Android: If you serve U.S. users, enroll in the relevant Play programs and ship by Jan 28. Align messaging across platforms.

What to do next (30‑day plan)

Week 1: Lock tiers per app, finalize price positioning, and rebuild EU LTV/CAC models. Draft in‑app promotion copy and disclosures.

Week 2: Implement promotion surfaces and deep links; wire up server‑side attribution and receipt matching. Start Android workstream for the Jan 28 deadline if applicable.

Week 3: Submit your EU builds, run a soft‑launch in one storefront cluster, and validate CTC calculations against test transactions. Spin up lifecycle messaging for annual plans.

Week 4: Expand the rollout, begin A/B tests on offer placement and pricing, and publish a public‑facing FAQ to reduce support load.

When Tier 2 actually wins

Plenty of teams will default to Tier 1, but don’t sleep on Tier 2 if you compete in dense categories where App Store discovery drives trial. A notes app with heavy search demand for “calendar with tasks” or a music lesson app riding “learn piano” can justify the 13% with incremental high‑quality installs. Measure by incremental revenue attributable to Tier 2 features versus the 8‑point spread to Tier 1.

A quick reality check on measurement

Attribution will never be perfect, but your finance team needs principled guardrails. Use server‑side eventing, receipt data, and storefront cohorting to estimate what share of web renewals are CTC‑eligible. Publish the methodology—and keep it consistent. If you ever get audited or your board asks why gross margin moved, you’ll be glad you did.

Working with a partner

If you need a sprint partner to wire this up, our team has shipped cross‑platform monetization and policy‑compliant funnels for subscription brands, fintech products, and games. Start here: what we do, browse a few relevant projects in our portfolio, and drop us a line via contacts. If you’re deep in recovery mode after recent search volatility, our 30‑day recovery plan for the December 2025 Core Update pairs nicely with this monetization work.

Risks, limitations, and the honest caveats

Policy language can keep moving, and enforcement details often clarify only once real apps push boundaries. Your safest posture is to implement clean, value‑forward promos, keep impeccable records tying purchases to installs, and budget engineering time for iteration. Also, don’t assume fee arithmetic is the only economic change—merchandising exposure is a meaningful variable. If Tier 2 drives fewer, but better, customers with higher ARPU, the math can surprise you.

Zooming out

Developers spent the last few years trying to predict when sweeping platform reform would arrive. It’s here. You don’t need a grand ideological stance; you need a steady roadmap and a finance model that matches the rules on the field. Done right, the 2026 EU model can actually improve margins for apps with strong direct funnels and healthy renewal rates, while still leaving the door open to lean on App Store discovery where it pays.

Want a second set of eyes on your model or a working session to stress‑test scenarios? We’re a message away.

Comments

Be the first to comment.