On December 11, 2025, the U.S. Ninth Circuit largely upheld a lower court’s contempt ruling against Apple and reaffirmed that developers can use App Store external links to steer users to their own payment pages. The panel criticized Apple’s past deterrents (like full‑screen warnings and tight formatting limits), while reopening the door for a “reasonable” commission on purchases that originate via those links. Translation: the window is open to ship external purchase flows—so long as you build for compliance and uncertainty.

I’ve helped multiple mobile teams ship external payment UX since May 2025, when Apple updated the U.S. App Review Guidelines to allow buttons and links without a special entitlement. What follows is the actionable playbook we’re rolling out this week: what changed, what to implement, and how to model margin with a potential fee on the horizon.

What just changed—and what hasn’t

Three dates matter. September 2021: the district court ordered Apple to allow links to outside payment options in the U.S. May 1, 2025: Apple updated the App Review Guidelines so U.S. apps can include buttons and external links without an entitlement and without discouraging copy limits that neuter the message. December 11, 2025: the Ninth Circuit agreed Apple violated the spirit of the 2021 order by deterring external links with design and policy restrictions, but it also said the lower court can set a reasonable commission framework for linked‑out purchases.

Here’s the thing: you’re free today to include external links in your U.S. iOS app, make them real buttons, and communicate clearly about pricing. But you should assume some fee may return in 2026 once the district court defines “reasonable.” Build your flows to win margin now and adapt quickly later.

App Store external links: the guardrails you must respect

The current U.S. rules allow you to include buttons, external links, or calls to action to your own website for digital goods and subscriptions. You can present them as a first‑class option alongside in‑app purchase. The appeals court made clear Apple can’t force you to make your option less visible than Apple’s—but Apple can limit overemphasis. Practically, design parity is your safe zone: comparable font size, placement, and copy weight to Apple’s default paywall patterns.

What about warnings? In the U.S., the prior full‑screen “scare screens” were singled out by the courts as improper. Expect standard disclosure language to remain, but not roadblocks. In the EU, external payments sit under separate DMA terms, so your interface and economics may differ. Use server‑driven configuration to localize copy, iconography, and fees by region.

Can Apple still charge a fee on external payments?

Not today in the U.S., but the appeals court told the district court to craft a reasonable-fee framework. Plan for a fee tied to costs of coordinating external links, not an arbitrary tax. You’ll want instrumentation that can report linked‑out conversions if and when rules require it.

Do I need to keep Apple’s IAP?

You’re allowed to link out without a special entitlement on the U.S. storefront. Whether you must offer IAP alongside depends on your business strategy and risk tolerance. Many subscription apps will keep both for now to minimize review friction, maximize conversion, and avoid confusing returning users who expect Apple billing.

Can I promote lower prices off‑App Store?

Yes, provided your copy is clear and truthful. The May 2025 guideline updates removed anti‑steering limits for the U.S. storefront, and the December ruling rejected Apple’s prior “plain text only” constraint. Keep claims precise: “Save 15% on the web” beats vague “cheaper elsewhere.”

The Monday‑morning rollout: a 10‑step external link checklist

If you want a concrete plan your team can ship this week, use this checklist. It’s opinionated, battle‑tested, and aimed at reducing review churn.

-

Design for parity, not superiority. Place your “Pay on the Web” button alongside Apple’s “Subscribe with Apple” choice. Match typographic scale, color weight, and placement. Avoid giant banners, motion, or sticky elements that overshadow Apple’s option. You don’t need to underplay your link—just don’t make it scream.

-

Write explicit value copy. One short sentence near the button is enough: “Pay on our site to access tax invoices, flexible payment methods, and lower prices.” Keep it factual. Avoid disparaging Apple or implying non‑existent risks.

-

Use a native browser handoff. Deep‑link to a secure, hosted checkout page (TLS, HSTS, modern cipher suites). Open in the default browser, not a webview. Persist a short‑lived token so the web flow knows the plan and price selected in‑app.

-

Offer equivalent SKUs. Align product names, durations, and entitlements between IAP and web to reduce support and chargeback friction. If you discount on the web, disclose it clearly.

-

Instrument link‑out attribution. Tag the click event with a non‑PII session identifier and expiration time. Store it server‑side. If a fee reporting regime returns, you can reconstruct which orders originated from in‑app links without fingerprinting.

-

Build a 2‑tap resume path. After successful checkout, deep‑link back to the app using universal links and validate the receipt or web token. Show “You’re all set—restore access” with one tap.

-

Handle refunds symmetrically. Web refunds shouldn’t break entitlement sync. Listen for webhook events and update the app within minutes. Publish a clear refund policy on the checkout page.

-

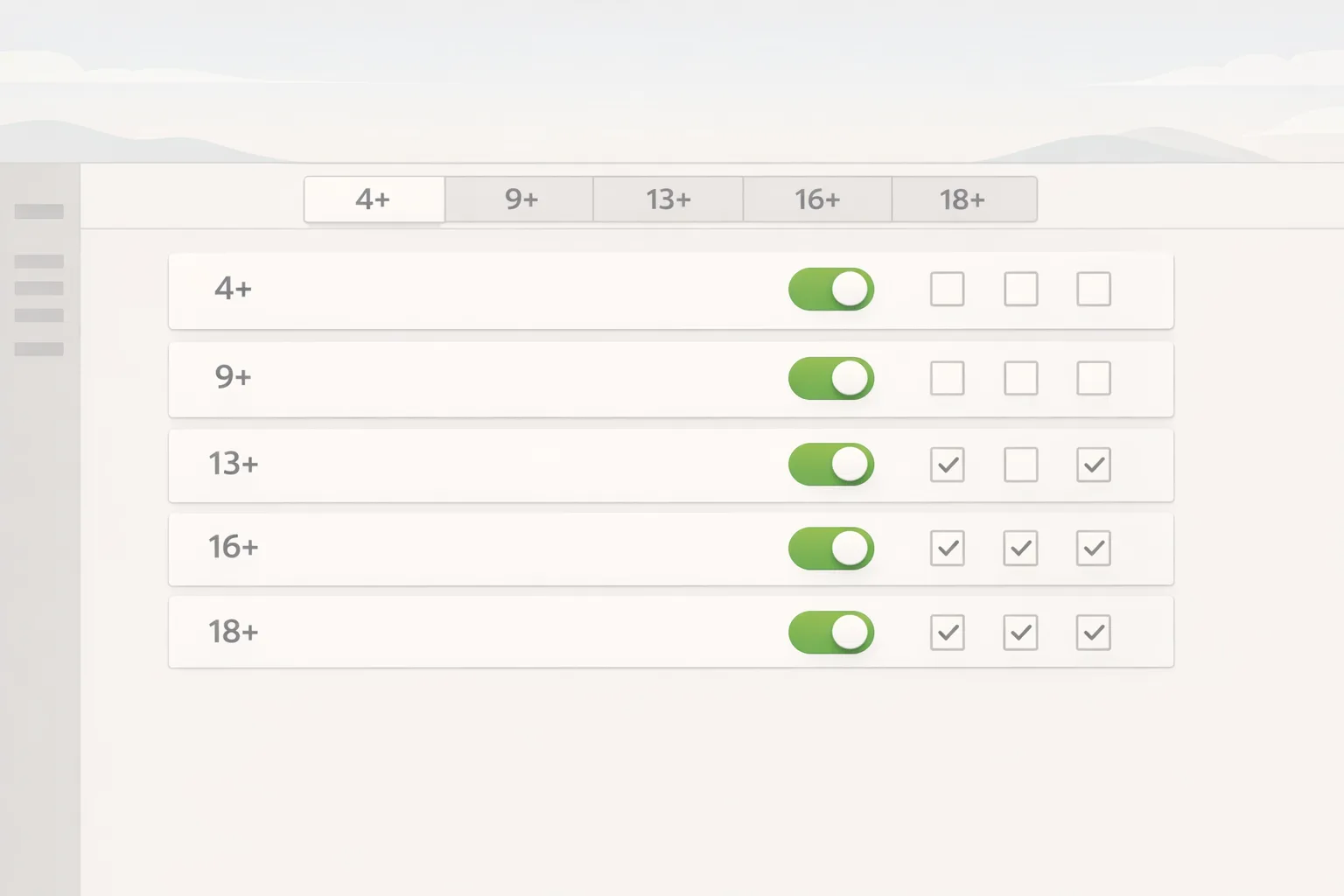

Localize by region. Use a feature flag to show or hide external links outside the U.S. For the EU, maintain a separate DMA‑compliant flow and copy. Keep a country overrides table you can update without app releases.

-

Prepare a review packet. Include screenshots of your paywall, link language, and the checkout URL domain you control. Explain your attribution approach and privacy posture in App Review notes to preempt questions.

-

Staff support. Expect a spike in “I paid on the web—why no access?” tickets in week one. Add an in‑app “Restore Web Purchase” button that asks for email and sends a magic link.

Pricing and margin modeling under uncertainty

Let’s get practical about numbers. Historically, Apple’s commission on IAP has been 15% for small-business program or long‑term subscriptions and up to 30% otherwise. Web processors charge roughly 2.5%–3.5% plus a small fixed fee per transaction. If the court sets a reasonable external‑link fee, expect something materially lower than old IAP rates and tied to coordination costs, not gross revenue capture. You should simulate three scenarios:

Scenario A: No external fee (today). Every web conversion lifts contribution margin by double digits versus IAP, even after processor costs. Your job: maximize safe adoption.

Scenario B: Low single‑digit fee. Treat it like a compliance cost. Target break‑even versus IAP by leaning into annual plans and bundles that monetize better off‑platform.

Scenario C: Mid single‑digit fee. Still favorable to IAP for most baskets, but thin enough that failed conversions hurt. Invest in reducing link‑out drop‑off: autofill, Apple Pay on the web, and post‑checkout deep links.

Build a workbook with sliders for fee %, processor rates, chargebacks, and offer mix. Model cohort LTV with and without IAP. If your web checkout supports multiple gateways, run cost‑based routing to shave basis points at scale.

UX that converts without tripping review

You don’t need clever tricks. You need clarity and speed. The winning pattern we see: a two‑option paywall with plain English copy, price parity or a modest web discount, and a fast, familiar checkout.

-

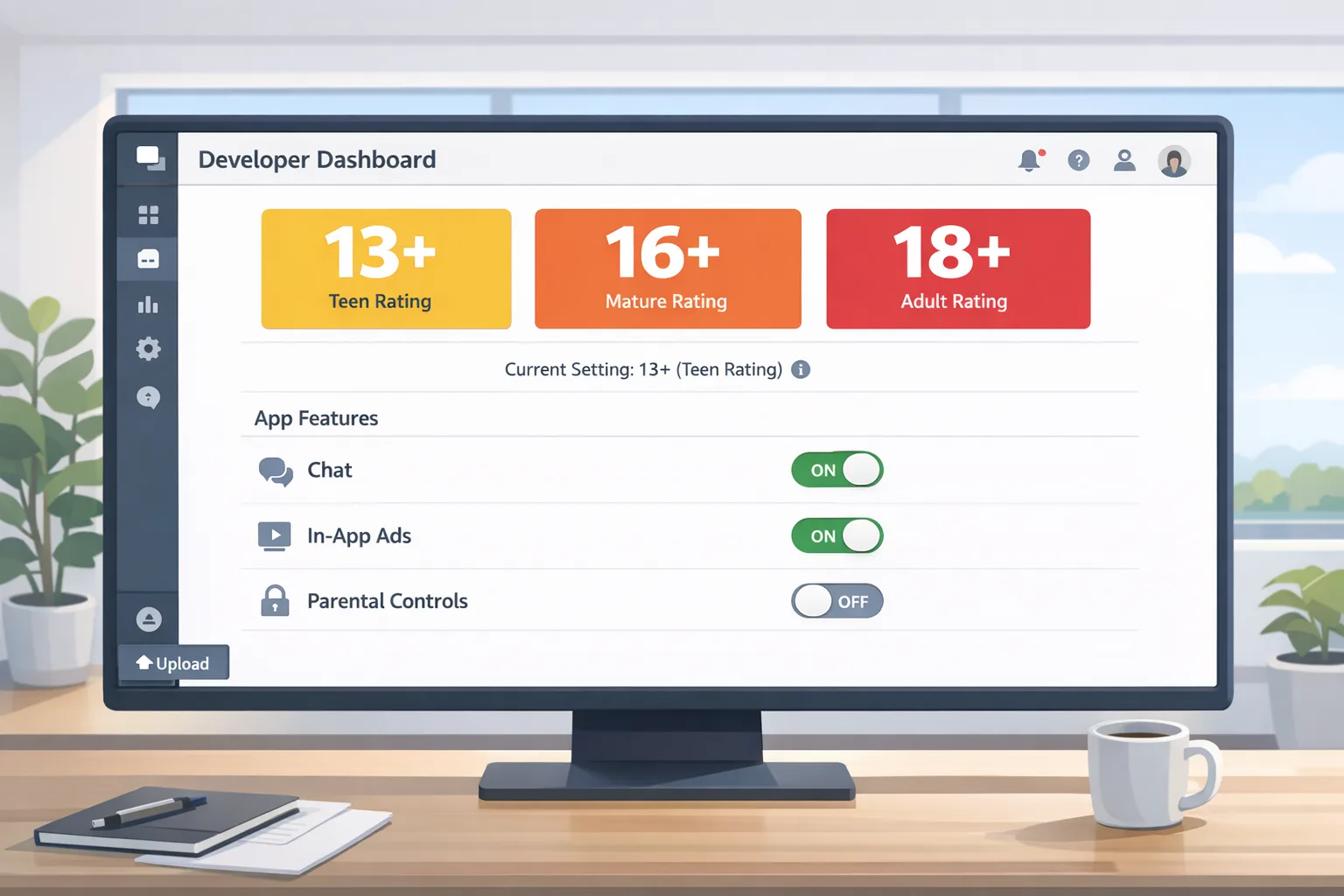

Two‑column paywall. Left: “Subscribe in App.” Right: “Subscribe on the Web.” Each with price rows and a short benefits list. Below: “Learn more” opens your pricing FAQ.

-

Familiar payment methods. Offer cards, PayPal, Apple Pay on the web where available, and regional methods like SEPA debit for EU stores. Don’t force account creation before payment—use email capture and a magic link to finalize profile setup later.

-

Transparent receipts. Show the legal entity, tax details, and a one‑click invoice download post‑purchase. Business buyers notice.

Need examples of tight, compliant copy and rollouts under pressure? See our earlier breakdowns on platform compliance pivots, including what developers changed the week rules shifted and a deep dive on what the external-links ruling actually unlocked.

Attribution, analytics, and “prove it” reporting

Even if no U.S. fee applies today, behave as though you’ll need to report linked‑out conversions in 2026. That means building a lightweight, privacy‑preserving chain of custody from tap to purchase:

In‑app event: paywall_view → external_link_tap (with session_id, country, SKU, timestamp). Store server‑side with a 7‑day TTL to mirror common windows without committing to any specific future rule.

Web checkout: propagate session_id in query params. On purchase, emit checkout_completed with the same id.

Reconciliation: nightly job joins external_link_tap to checkout_completed on session_id within TTL, outputs an aggregate table keyed by day, SKU, and storefront.

Auditable logs: keep hashed email and last‑4 BIN for fraud review only, segregated from attribution tables. Document retention and access in your privacy policy.

This setup lets you prove which revenue came from link‑outs without fingerprinting. If a court‑ordered fee model arrives, you can comply quickly. If it doesn’t, you’ve still earned trustworthy paywall analytics.

Risks, edge cases, and how to blunt them

Review variability. App Review can be inconsistent week to week. Mitigate with a clearly documented review note, parity design, and conservative animations. If a rejection cites prominence, downshift your web button weight by one tier (e.g., from filled to outline) and resubmit.

Regional fragmentation. The U.S. storefront now differs from the EU’s DMA flows and other markets. Keep a server‑side rules engine that toggles link availability, warning copy, and pricing labels by store country.

Entitlement drift. Because Apple changed its stance multiple times since 2021, code your paywall as a configuration surface, not a hardcoded screen. You should be able to switch to web‑only, IAP‑only, or both, without a client update.

Support and refunds. Split refund support macros by IAP and web. In the app, “Restore Web Purchase” should not trigger Apple’s restore API—keep those flows separate to avoid confusion.

Fraud and abuse. External payments can raise friendly fraud. Use 3D Secure where appropriate, velocity checks on trial churners, and a blacklist of compromised BINs. Keep your dispute evidence template ready: paywall screenshot, IP geolocation, device match, and entitlement logs.

People also ask

Will external links hurt in‑app purchase conversion?

If you design for parity and clarity, you’ll likely move price‑sensitive users to the web while retaining one‑tap buyers on IAP. The goal isn’t to kill IAP; it’s to give adults a choice and capture margin from the buyers who care.

Can we make the web price lower?

Yes, and many teams are doing it. A modest 10%–15% web discount is enough to shift buyer behavior without looking like a bait‑and‑switch. Display taxes and recurring terms identically on both options.

Is a webview allowed?

Don’t risk it. Open the default browser and keep the checkout on a first‑party domain you control. It’s faster, safer, and easier to defend in review.

How do we handle family sharing and upgrades?

Draw a bright line: Apple‑billed subscriptions get Apple’s platform perks; web‑billed subscriptions get your perks. Publish a comparison chart in your pricing FAQ and link it from the paywall.

A one‑page framework for execs

Use this to align product, finance, and legal in 30 minutes.

Objective: Increase contribution margin by shifting 25%–50% of new U.S. subscribers to web checkout without reducing overall conversion.

Levers: two‑option paywall, modest web discount, Apple Pay on the web, fast deep‑link resume, and targeted CRM nudges for high‑intent prospects.

Guardrails: parity design, truthful copy, no dark patterns, native browser handoff, region‑aware toggles, and auditable attribution.

Metrics: paywall CTR split (IAP vs web), link‑out to checkout start rate, checkout completion rate, refund rate, net margin per subscriber, and support tickets per 1,000 users.

Decision triggers: if IAP conversion drops >5% absolute, reduce the web discount; if support tickets double, add “Restore Web Purchase” in the paywall footer; if fraud rate rises, enable 3DS on high‑risk geos.

What to do next (this week)

-

Ship a parity two‑option paywall on the U.S. storefront with clear, factual copy about pricing and billing ownership.

-

Stand up a hosted, secure web checkout with Apple Pay on the web and one‑tap deep‑link return to the app.

-

Instrument link‑out attribution with a short‑lived session_id and nightly reconciliation tables.

-

Build a fee‑scenario workbook for finance and set pricing tests: parity, 10% off web, and annual‑first bundles.

-

Prepare App Review notes and screenshots; train support on web vs IAP flows and refunds.

Where we can help

If you want a hands‑on partner to blueprint the paywall, attribution, and legal review packet, our team has shipped these transitions under pressure for B2C and B2B apps. Start with our what we do overview, browse relevant launches in the portfolio, or reach out via contact. For more platform‑change playbooks, see our earlier analysis on external links and what the ruling changes and the operational guide in what developers change now.

Zooming out: the strategic view

This moment isn’t just about swapping payment processors—it’s about diversifying your economic stack. The web checkout you build now powers bundles, annual prepay, B2B invoices, and partner codes that were clumsy or impossible inside IAP. Even if a modest external‑link fee returns, you’ll keep flexibility and negotiating leverage, because you no longer depend on a single channel to collect money.

There’s also a cultural shift. For years, teams treated the paywall as a single monolith tuned for Apple’s rules. Going forward, treat it as a policy‑aware surface that adapts by storefront and regulation. That makes you faster than rivals when the next court order lands—and one will.

Ship the basics this week. Measure cleanly. Iterate calmly. And keep your paywall ready for the next change rollup. The winners won’t be the loudest—they’ll be the ones who built with composure and left themselves room to move.

Comments

Be the first to comment.