The fight over App Store external links is no longer a theoretical debate. On December 11, 2025, the Ninth Circuit mostly upheld a contempt finding against Apple for undermining an earlier injunction, yet gave Apple a path to collect a reasonable commission on purchases that happen after users tap an in‑app link to your website. It also clarified how prominent those links can be. This isn’t just headlines—it’s your roadmap for shipping compliant UX and sound pricing in 2026. (reuters.com)

Here’s the thing: the court affirmed the right to link out, rejected Apple’s prior approach that made links hard to use, and sent the question of what fee Apple can charge back to the district court. Until a new rate is set, you need to plan for multiple fee scenarios—and adjust your tracking and checkout journeys accordingly. (macrumors.com)

What exactly did the Ninth Circuit decide?

First, the panel agreed there was clear evidence Apple violated the spirit of the 2021 injunction that allowed developers to steer users to external payments. That contempt finding stays. Second, the appeals court said a total ban on Apple charging any commission for those external transactions went too far. Apple can seek a “reasonable” commission, but the lower court has to define what that is and how it’s calculated. (reuters.com)

Third, on design and language, the court rejected Apple’s attempt to suppress link utility. Apple can stop developers from over-emphasizing external links relative to in‑app purchase (IAP) buttons, but it must allow parity for fonts, sizes, and placement. In other words, you can’t make your web checkout shout while IAP whispers—but Apple can’t force your web link to hide in the footer either. (macrumors.com)

Finally, a timing nuance matters for your finance team: according to reporting on the ruling, Apple cannot collect any commission on external links until the district court approves a compliant rate. That puts a temporary zero on Apple’s external-link take in the U.S.—but don’t build your 2026 plan on zero. Model a range and be ready to pivot. (macrumors.com)

What does this mean for App Store external links in the U.S.?

Practically, you can keep (or start) steering users to your website for checkout on the U.S. storefront. You should design the link with at least equal prominence to any IAP option and use clear, customer-friendly copy that doesn’t run afoul of Apple’s general content standards. You should also assume some commission will return—and that Apple will try to tie it to demonstrable costs of coordinating external links and possibly IP usage, not to amorphous “security and privacy” buckets. (macrumors.com)

Link prominence and UX: do’s and don’ts

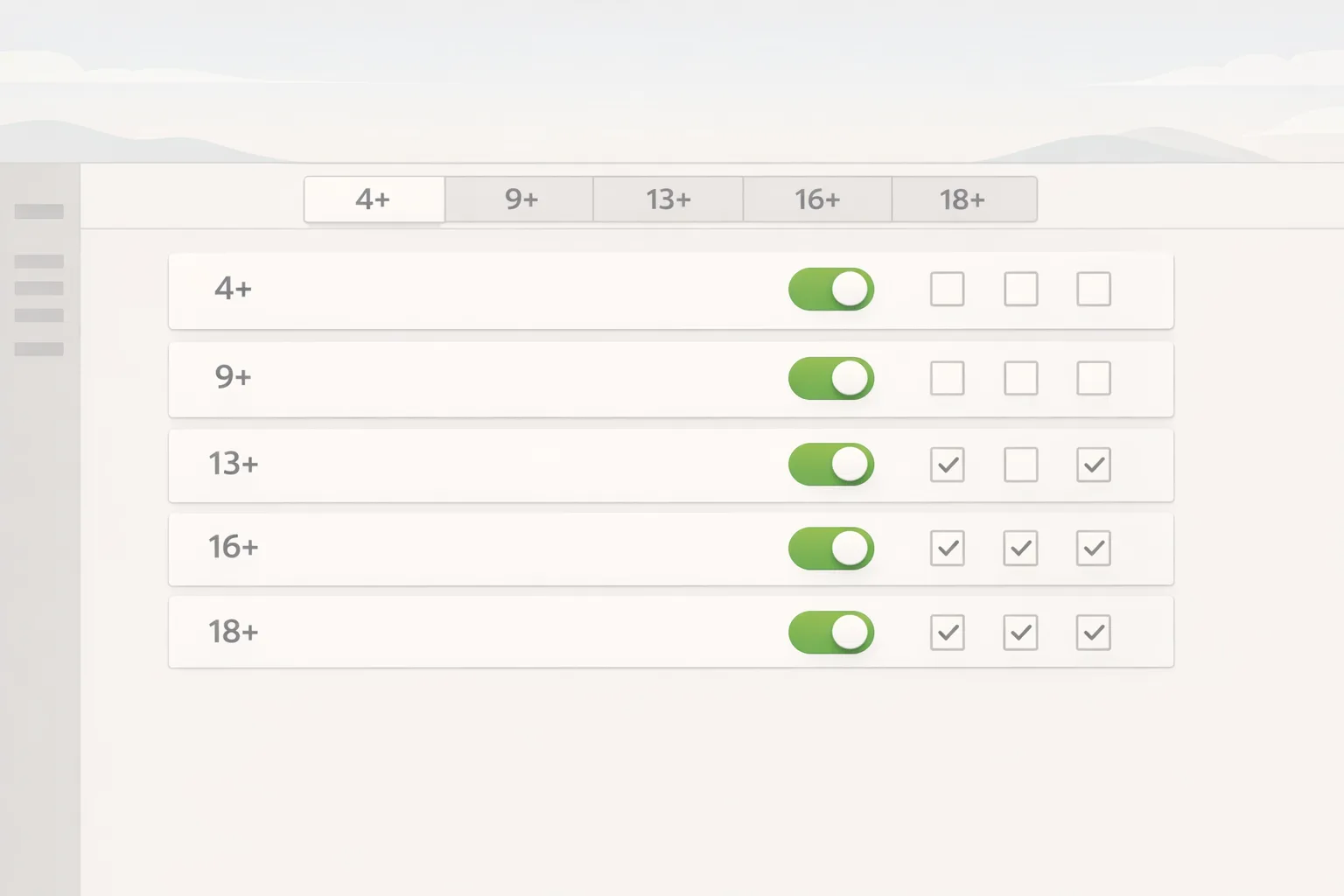

Do match IAP in size, placement, and visual weight. Do write straightforward labels like “Buy on our website” or “Subscribe on the web.” Don’t bury the link or make it intentionally confusing; that undermines your own conversion and hands Apple ammo in future disputes. Don’t crank the web CTA to billboard scale while minimizing IAP; that’s exactly the over-emphasis the court said Apple can restrict. (macrumors.com)

Language and warnings

Expect Apple to keep a disclosure sheet when users leave the app. Fine. Treat that as part of your funnel; test language before and after the sheet, and make sure your landing page speeds are sub‑second. That “Are you sure?” moment is where a surprising chunk of users bounce. Build trust cues and price clarity immediately after the hop.

About fees: what changes and when?

History matters. After the 2021 order allowed steering, Apple introduced a policy to charge 12% (Small Business Program) or 27% (standard) on purchases made within seven days of a tap on an external link—policy that few developers embraced because, when combined with PSP costs, it often beat or matched IAP’s headline rake. That approach drew the contempt fire. (9to5mac.com)

Now the appeals court says Apple can charge something, but not anything. The new commission must be “reasonable,” grounded in the costs of coordinating external links and limited compensation tied to IP—not a backdoor to the old rates. The district court will set the playbook next. Until that order lands, assume zero in the U.S., but plan scenarios for 3%–12% to stress-test pricing, CPIs, LTV models, and channel mix. That isn’t a prediction; it’s disciplined planning. (macrumors.com)

How the EU is different (and why U.S. teams should still care)

Under the EU’s Digital Markets Act, Apple has been iterating a separate fee regime. In June 2025, Apple outlined a framework that swaps the notorious Core Technology Fee for a 5% Core Technology Commission on external-link purchases under certain terms, with developers moving to the new rules by January 1, 2026. It also layered an initial acquisition fee and tiered store services fees depending on developer choices. Whatever you think of the math, this is Apple experimenting in public with structures regulators will actually tolerate. (techcrunch.com)

If you operate in both regions, do not unify pricing logic blindly. The U.S. commission will be court-defined. The EU commission and fees are policy-defined—and changing. Keep billing codepaths and analytics cleanly separated by region to avoid nasty surprises when audits roll through.

The practical framework: Steer, Track, Reconcile

Here’s the playbook we’re shipping on teams that run subscriptions or digital goods across app and web:

1) Steer with parity

Design a purchase panel that shows IAP and web checkout options with equal prominence. In a two‑column layout, give both CTAs identical size and positioning. Use plain labels and price parity unless or until your tests show a clear reason to differentiate. Keep the flow as few taps as possible after Apple’s disclosure sheet. (macrumors.com)

2) Track with privacy-safe tokens

Replace the old seven‑day cookie‑style attribution mindset with first‑party tokens that expire quickly and don’t depend on any Apple SDK to function. When a user taps “Buy on the web,” generate an HMAC‑signed token tied to the app, anonymized user ID, SKU, timestamp, and storefront. Pass it in the link querystring and store it server-side. On web purchase, validate the token, close the loop, and drop the token. This gives you auditable linkage for any court‑approved commission while respecting privacy.

3) Reconcile like a payments company

Build a daily ledger that rolls up: app taps, web checkouts, refunds, and chargebacks by storefront. Assume you may need to calculate a commission only for purchases attributable to tap‑throughs within a defined window. You can model the window later when the court orders specifics. The point is being ready to compute it with provable integrity on day one.

Data you should keep (and why)

Keep: signed tap events (timestamp, app build, storefront, device locale), landing URL variant, PSP transaction IDs, tax treatment, and the final net revenue. Don’t keep: unnecessary PII that complicates GDPR/CCPA surface. If you’ve built strong event hygiene for ad attribution, this is familiar territory, just with a legal‑policy twist.

People also ask

Can Apple still block my external link?

No, the right to steer remained intact, and Apple’s previous efforts to cripple links were called out. Apple can restrict links from being more prominent than IAP, but must allow at least parity in font, size, and placement—and it can enforce general content standards. (reuters.com)

Do I need a special entitlement on the U.S. storefront?

Not now. After the spring rulings, Apple removed the entitlement requirement and explicit anti‑steering language for the U.S., which is why so many apps quietly added web CTAs in mid‑2025. Keep an eye on Apple’s developer news posts for any updates as the district court sets a commission. (9to5mac.com)

When will the new commission rate take effect?

There’s no final number yet. The Ninth Circuit sent the issue back with guidelines; until the district court defines the rate, reporting indicates Apple can’t collect a commission on external links in the U.S. Expect movement in early 2026 and design your systems so you can flip a switch without a rushed rebuild. (macrumors.com)

Modeling the money: three scenarios to budget now

Scenario A (0% through Q1 2026, 3% thereafter): Your web checkout remains materially more profitable than IAP; invest in funnel optimization and pre‑purchase education to drive taps. Scenario B (0% through Q1 2026, 7% thereafter): Margins still beat IAP; scrutinize PSP fees and fraud tooling to protect net. Scenario C (0% through Q1 2026, 12% thereafter): Web margins narrow; the swing factor is whether you gain enough price and UX freedom to out‑convert IAP. In all cases, run sensitivity on refunds and churn; don’t assume payment method neutrality.

U.S. vs EU: operational differences you can’t ignore

In the U.S., courts will define what’s “reasonable.” In the EU, Apple has codified a menu of fees, including a 5% Core Technology Commission for external‑link purchases under certain terms and a migration to that structure by January 1, 2026. If you run global apps, resist the temptation to share back‑office math between regions; the audit questions and proofs you’ll need are different. (techcrunch.com)

Risk, edge cases, and gotchas

Edge case: upgrade flows. If a user buys on web and later upgrades inside the app, expect Apple to claim commission on the IAP portion as usual. Edge case: family sharing and multi‑seat licenses; your web checkout needs clarity on how access propagates back to the app. Risk: over‑promising “lower prices on the web” when exchange rates and taxes erase the delta. Also risk: treating the disclosure sheet as an afterthought—it’s a conversion choke point that demands design attention.

Let’s get practical: your 10‑step implementation checklist

1) Audit your current purchase surfaces and map where the web CTA should live with parity to IAP. 2) Draft link copy variants; run quick usability tests to pick the clearest one. 3) Add a signed, expiring token to your external link and instrument server‑side validation. 4) Build a ledger for taps, checkouts, refunds, and disputes by storefront. 5) Create dashboards for attach rate and time‑to‑purchase post‑tap. 6) Prepare a commission calculator that can ingest a court‑defined rate and retro‑compute liabilities. 7) Update taxes and receipts on the web to match your app’s entitlement logic. 8) Improve page speed on the landing URL—no excuses above 1s TTFB. 9) Train support on the differences between IAP and web entitlements. 10) Stage a feature flag so you can activate or adjust the web CTA per region instantly.

What to do next this month

- Ship the parity link with server‑side tokens and a daily ledger. - Run A/B on link placement and copy that respect parity rules. - Model 3%, 7%, and 12% commission scenarios against LTV and CAC. - Brief legal and finance on the remand posture and your audit plan. - If you operate in the EU, finalize your migration plan for Apple’s January 1, 2026 fee regime. (techcrunch.com)

Zooming out

This ruling didn’t “end the Apple Tax”; it changed the math and the accountability. Apple will get to argue for a commission; developers will get to hold it to provable costs and parity UX. If you’re disciplined about instrumentation and honest about funnel performance, you’ll win more than you lose in 2026.

If you want a quick sanity check on your plan, our team runs focused audits and shipping sprints for mobile monetization and compliance. See how we scope engagements on our what we do page, browse relevant case notes in our portfolio, or book a short working session via contact. For ongoing coverage of platform shifts like this, subscribe to the ByBowu blog.

FAQ for execs to send your teams

- “Can we remove IAP entirely now?” No. You can prioritize web checkout, but many users expect Apple Pay in‑app and some features (like family sharing) may be simpler with IAP. Keep both options and let data decide the mix. - “Are we safe ignoring this until the court sets a rate?” No. The UX and tracking work take time, and late compliance is expensive. - “Will Apple try a look‑back window again?” Possibly, but any window must fit within the court’s guidelines; build tokens and ledgers so you can compute fairly without guesswork. (9to5mac.com)

Want help turning this into a two‑week sprint? We can pair your PM, designer, and iOS lead with a bybowu.com senior to ship the parity link, tracking tokens, and reconciliation ledger quickly. Explore services and reach out via contacts. We’ve done similar for clients navigating platform policy changes and security hardening—see our approach in posts like our swift incident playbooks and upgrade guides across the blog.

Comments

Be the first to comment.