On December 12, 2025, every mobile product team woke up to a new reality: the App Store ruling in the Apple–Epic case largely upheld a contempt finding against Apple, but reopened the door for “reasonable” commissions on external payment links. That’s a mouthful, but the implications are concrete—link design, fee exposure, and go-to-market timing for iOS subscriptions all shift, again. Add Google’s December 9 policy update expanding alternative billing and external links for U.S. users, with a January 28, 2026 deadline, and you’ve got a clear mandate to re-plan your checkout stack.

I’ve led several mobile commerce rewrites across regulated markets. The pattern is always the same: the law moves, platforms adjust, and teams succeed or stumble based on how quickly they translate policy into shippable UX and verifiable finance ops. Let’s cut through the noise and get you a plan.

What the App Store ruling actually says (and why it matters)

The appeals court affirmed that Apple violated the original anti-steering injunction by making external payments impractical—27% “link-out” commissions, restrictive link formatting, and deterrent screens. But it also held that a blanket ban on any commission went too far. The case returns to the district court to set a reasonable fee tied to costs (and some IP value) for transactions initiated via in-app links.

Three consequential takeaways for iOS builders:

First, Apple can’t punish external links with dark patterns or inferior prominence. Expect App Review to permit buttons or links that are at least as discoverable as in-app purchase options. You won’t be allowed to make them wildly more prominent, but the “needle-in-a-haystack” era is over.

Second, the fee conversation isn’t settled. The court rejected Apple’s 27% approach, but it didn’t set a new percentage. It did indicate fees should reflect actual coordination costs and limited IP considerations—not broad “platform value.” In practice, that implies a materially lower rate than historical IAP commissions, but you must plan for non-zero.

Third, timing is everything. Until the district court formalizes a number, Apple’s ability to collect a commission on link-outs is constrained. Teams will be tempted to rush web checkout flows into production. Do it deliberately: design for variable fees, document your attribution, and be ready to adapt once the new rate lands.

App Store ruling: how it impacts your revenue model

Here’s the thing: this isn’t just legal theater. It directly changes your unit economics and CAC payback if you sell digital goods or subscriptions on iOS.

For subscription apps (media, productivity, education), the immediate upside is higher take-rate when you route signups to your site. Even with a future “reasonable” fee, the blended cost should beat legacy IAP. For one-time purchases (pro features, game passes), external checkout gives you pricing flexibility (tiering, bundles, coupons, regional experiments) that IAP historically constrained.

But there’s a catch: customer experience. Web checkout introduces friction—browser handoff, sign-in, and card entry. Your conversion rate lives or dies on excellent handoff UX, biometric payment options, and one-tap return to the app. The legal win is only a win if your flow converts.

Should we ship external payments on iOS right now?

Short answer: yes, but treat it like a controlled rollout with a proper business case. The App Store ruling makes it safer to invest in link-out. The unknown fee means you should target flexible economics, not zero cost.

Recommended approach:

• Start with new-user acquisition flows on high-intent screens (e.g., paywalls after trial). Use a native, clearly labeled button that deep-links to an optimized web checkout. Avoid confusing multi-step menus. Keep labels factual and neutral.

• Keep IAP available where it’s convenient (restores, family sharing, Apple Card cashback users). You’re reducing platform dependency, not abolishing it overnight.

• Track cohorts where users saw external links versus IAP. Use post-purchase receipts and server-side attribution rather than brittle client heuristics.

How this lines up with Google Play’s December changes

On December 9, 2025, Google expanded U.S. eligibility for alternative billing and launched an external content links program, with a January 28, 2026 compliance deadline for developers who want to keep linking or using alternative payment systems. That’s a concrete clock for Android teams.

Practically, you can now align your iOS and Android checkout strategies in the U.S. market: consistent pricing, single web checkout stack, unified tax and compliance, and a shared risk model for platform fees. If you’ve dabbled in User Choice Billing on Android, you’re halfway there. If not, now’s the time to lay rails.

Architecture that works: the dual‑rail checkout pattern for 2026

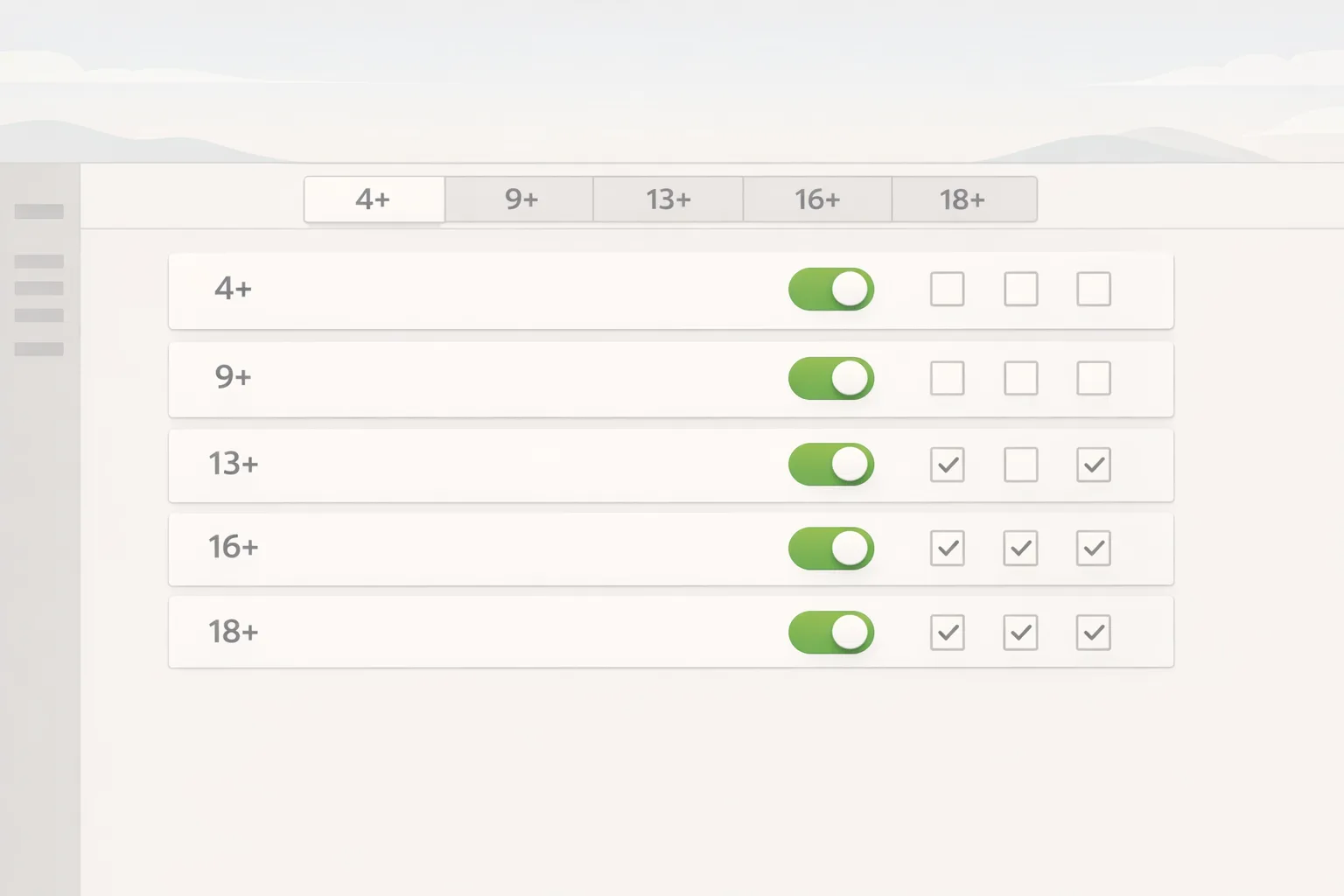

Ship a “dual‑rail” design: both native IAP and web checkout, each first-class, lit by server-configurable rules. You need four building blocks:

• Policy engine: a remote-config service that toggles visibility, copy, and placement based on platform, country, and campaign. Store versions with timestamps to prove intent if your app review gets flagged.

• Handoff service: a signed, short‑lived link that carries SKU, price, currency, user ID, and return URL. The app opens the system browser with that link; the web completes payment; then it redirects back into the app via universal link to finalize entitlements.

• Entitlement service: a backend that mints and revokes access across both IAP receipts and web orders. Never trust the client for unlocking premium. Run reconciliation jobs that match orders to device IDs and sessions.

• Fee abstraction: model platform fees explicitly in your billing system: rate, basis, attribution window, and who pays (you or the user). That way, when the district court sets Apple’s “reasonable fee,” you update a config, not your code.

A compliance and UX checklist your team can use today

Here’s a tight, practical list. Grab your PM, iOS/Android leads, design, legal, and finance. One working session, ninety minutes.

1) Copy and prominence. Ensure external links are at least as prominent as IAP options, but not exaggerated. Use plain labels like “Pay on our website.” Avoid scare language or platform-bashing.

2) Placement parity. Match Apple’s guidelines on size, font, and placement relative to IAP buttons. Screenshot your paywall and keep it in your review archive.

3) Browser handoff. Prefer the default system browser and a frictionless return path. Pre-fill email with user consent, and honor password managers and passkeys out of the box.

4) Payments. Support Apple Pay on the web where available plus a card vault with network tokens. Add PayPal and regional options only where they move the needle.

5) Taxes and invoices. Your web checkout must calculate VAT, GST, and U.S. sales tax correctly. Send real receipts with the correct seller of record and refund policy.

6) Attribution window. Document how you associate a link click with a later purchase if the user completes on another device. Keep it conservative; courts frown on expansive claims.

7) Abandon recovery. Capture email early (with consent) and send a one-click resume link. Don’t spam; two reminders are plenty.

8) Entitlements. Grant access server-side within seconds and show an in-app confirmation. If the app was backgrounded during checkout, detect the return and refresh state instantly.

9) Support. Add a “Payment options” help article inside the app. Train support on refunds and chargebacks for web orders versus IAP.

10) Audit trail. Store versions of your paywall and link settings with dates, app versions, and markets. If App Review asks, you have a clean record.

People also ask

Can Apple still charge fees on external links?

Yes—once the district court sets a reasonable rate tied to costs and limited IP value. The appeals decision rejected Apple’s 27% approach and sent the fee question back to be recalculated. Design your billing system so that fee changes are configuration, not code.

Will Apple allow bigger buttons or different styling for web links?

You can present external links at least as prominently as in-app purchase controls. Making them substantially more prominent is likely to be constrained. Keep parity on size, font, and placement; don’t bury them, don’t shout either.

Do small developers benefit from alternative billing?

Absolutely—if you can execute a clean web checkout. Smaller teams win on flexibility (bundles, discounts, trials) and owning the customer relationship. Just budget for taxes, fraud tooling, and support that Apple previously shouldered.

Data points and dates to put on your roadmap

• December 11–12, 2025: Appeals court upholds contempt, rejects zero‑fee ban, remands to set a reasonable external-link commission.

• December 9, 2025: Google Play expands U.S. alternative billing and external links; developers using these programs must comply by January 28, 2026.

• Early 2026: Expect movement on the iOS fee number. Build your pricing and margin models with a sensitivity analysis (for example: 0.5%, 2%, 5%).

Pricing playbook: how to model the new economics

Start with your current blended take-rate: the weighted average across IAP and external. Run three scenarios:

• Low-fee: external link commission under 1%. Likely best case; maximize link-out on first purchase, keep IAP for renewals where it truly reduces churn.

• Mid-fee: 2–5%. You still come out ahead versus 15–30% historic IAP, but you’ll want stronger abandoned checkout recovery to offset web friction.

• High-fee: 6–10%. Revisit whether certain SKUs (impulse buys under $5) stay on IAP for conversion and fraud protections. Keep link-out for higher AOV and annual plans.

Pair each with a conversion delta assumption (web vs IAP). If your iOS web flow underperforms by more than 10–15% conversion, fix UX before scaling traffic.

Operational guardrails most teams skip

• Refunds and proration. Implement self‑serve cancellation and proration logic for web subscriptions so support isn’t the bottleneck. Mirror Apple’s refund affordances where reasonable.

• Chargebacks. Set up webhooks from your processor and reconcile daily. Mismatch between entitlements and chargebacks is how you leak revenue.

• Compliance. Keep your privacy disclosures tight, especially if you use third‑party analytics on paywalls. Don’t collect more data just because you can; regulators are watching mobile monetization closely.

Zooming out: platform strategy, not platform whiplash

This moment favors teams that treat payments as a product, not a plug‑in. A dual‑rail strategy reduces platform risk, gives pricing agility, and lets you build real customer relationships. It’s also messier—you own taxes, fraud, and support. That’s a fair trade if you want margin and long‑term control.

If your organization needs a partner to operationalize this, our team has shipped these changes across multiple stacks and markets. See what we tackle on our what we do page, explore relevant case notes on the Bowu blog, and reach out via contact to pressure-test your approach. If you’re revamping billing ops, our recent playbook on year‑end developer tooling budgets pairs well with this work: how to handle December billing requests.

What to do next (developers and business leaders)

• This week: Align legal, product, and engineering on the ruling. Decide your stance on external links vs. IAP per SKU. Create a remote‑config plan for button parity and copy.

• Next 2–3 weeks: Ship a high‑polish web checkout with biometric pay, clean return flow, and instant entitlement. Instrument conversion and abandonment, and set up tax and invoice services correctly.

• January: Roll out to 25–50% of new iOS users, hold out a control group on IAP, and compare revenue per install. On Android, ensure you’re compliant with Google’s programs by January 28, 2026 if you’re linking or using alternative billing.

• Quarter ahead: Model fee sensitivity (0.5–10%), build pricing levers you can pull without a release, and keep your policy engine flexible for region-by-region updates.

If your team wants a pressure-tested rollout plan or an audit of your checkout economics before you ship, start a conversation via our services page. We’ll help you set the rails once, so the next policy swing doesn’t derail your roadmap.

Comments

Be the first to comment.