App Store EU Fees 2026: A Developer’s Playbook

If you sell digital goods or subscriptions in the EU, you now live with App Store EU fees 2026: a 5% Core Technology Commission layered onto a two‑tier Store Services fee (5% or 13%) and, in certain journeys, a 2% initial acquisition fee. Apple’s per‑install Core Technology Fee is being phased out as the company moves to a single EU model. That means your pricing, growth loops, and in‑app purchase flows may need a rethink—not in theory, but in this quarter’s numbers.

App Store EU fees 2026: what actually changed

Let’s pin the key mechanics so teams stop arguing in Slack and start shipping with confidence.

What’s live in 2026 for EU distribution:

• Store Services fee: Two tiers. Tier 1 is 5% for core distribution, trust and safety, and basic engagement. Tier 2 is 13% (10% for Small Business Program) and includes the fuller App Store feature set like curation, insights, and additional marketing capabilities.

• Core Technology Commission (CTC): 5% commission that applies to qualifying digital goods sold outside Apple’s in‑app purchase rails when you communicate and promote offers inside the app (e.g., external link flows). Apple has stated it’s moving EU developers to a single business model built around the CTC.

• Initial acquisition fee: 2% in specific external‑link journeys—think of it as Apple charging for the channel’s first conversion assist.

• Per‑install Core Technology Fee: sunset path as the business model unifies in 2026. No more €0.50 over‑a‑million‑installs math hanging over growth teams.

There are still carve‑outs and nuances (for example, whether you only reference outside offers without an actionable link versus providing an actual external purchase path), but the day‑to‑day takeaway is simple: every EU app team should re‑model effective take rates and price points now.

How the new fees stack up in real product flows

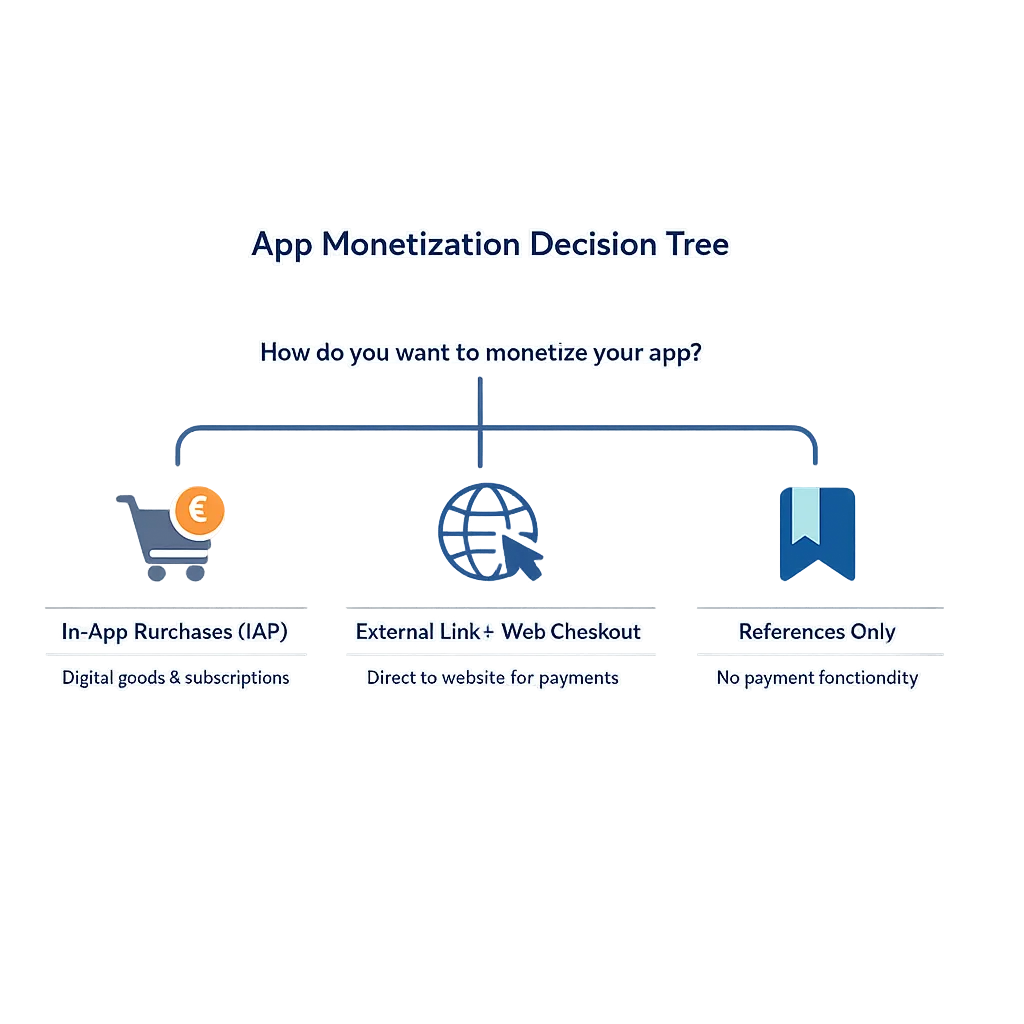

Here’s the thing: the fee picture only makes sense when you map it to actual screens and sessions. Three common patterns:

1) Stay fully inside IAP

You rely on Apple’s in‑app purchase for all digital goods. You get App Store convenience and enforcement protections, and you avoid external reporting overhead. The tradeoff: Apple’s standard IAP commissions still apply. If you prioritize frictionless first‑run purchase UX and don’t have a strong off‑platform billing engine, this can still be the right call.

2) Promote an external offer with an actionable link

Inside your iOS app, you present a “Subscribe on web” link or QR that deep‑links to your checkout. You assume the added work of analytics, user matching, compliance, customer support, and Apple’s reporting for external transactions. The upside: you control billing and can unify pricing across platforms. The fee stack here usually includes the Store Services tier (5% or 13%), the 5% CTC, and possibly the 2% initial acquisition fee on the first conversion. Your PSP costs, VAT handling, risk screening, and chargeback ops still apply, too.

3) Reference off‑App Store offers without a link

You mention the availability of better pricing off‑platform but don’t provide a tappable path. Depending on your terms and actual implementation, your mix of Store Services and CTC may differ. It’s less elegant for users, and conversion drops compared to an actionable link, but you can limit technical complexity.

Teams that do this well pair messaging with strong email and push automations to finish the sale on the web after an account is created in‑app.

Pricing math: a quick, defensible modeling approach

Don’t guess—model. Use conservative assumptions, then iterate when your telemetry lands.

1) Start with your price points. For example, €9.99 monthly, €59.99 annual, €4.99 consumable.

2) Layer in platform fees by flow. For an external‑link subscription conversion, model Store Services Tier 1 at 5% plus a 5% CTC, and include the 2% initial acquisition fee on a user’s first purchase if it applies. For App Store IAP, apply Apple’s IAP rate. For Tier 2, model 13% (or 10% for Small Business Program) where appropriate.

3) Add payment processor costs for web (e.g., ~1.2%–2.9% + fixed) and your fraud/chargeback assumptions (e.g., 0.1%–0.5% burn depending on category).

4) Add VAT. Remember: EU VAT is destination‑based. If your PSP doesn’t handle it end‑to‑end, you must.

5) Forecast behavioral lift or drop. External links often shift conversion curves: longer funnels, more leaks, but larger LTV from cross‑platform billing. Start with a −5% to −15% conversion delta on the first session versus IAP and revisit with live data.

6) Run sensitivity analysis. Stress test with ±3% swings in fees and ±10% swings in conversion.

Once you have per‑flow unit economics, let that drive the UX decision instead of dogma.

Decision framework: which path should you take?

Use this checklist in product review next week:

- If your business is primarily subscription SaaS with a mature web checkout, push toward external links and Tier 1. The lower Store Services fee often nets a better margin even after CTC and PSP costs.

- If you’re games or media with high IAP attach and impulse buys, the IAP path may still win on conversion and ARPDAU even at the higher commission.

- If you rely on App Store merchandising, editorial, and discovery, Tier 2’s extra capabilities might justify the higher fee.

- If your ASO is excellent and you expect heavy first‑run conversions via search/discovery, budget for the 2% initial acquisition fee when you send people off‑platform to close.

- If your category is high‑risk for fraud/chargebacks, keep IAP for the riskiest SKUs and move only the high‑confidence products to web billing.

Engineering and ops: what changes in your backlog

Let’s get practical. Turning on external purchase paths isn’t just a settings toggle.

Product & UX

- Offer design: place the “Buy on web” CTA where intent is highest, not on the first screen. Use copy that emphasizes account benefits, not “avoiding fees.”

- Funnel integrity: include account creation and verified email/phone before handing off to web to improve match rates on the way back.

- Edge cases: decide how you treat family sharing, gift codes, and upgrades/downgrades when the source of truth is web billing.

Client & API

- Link handling: deep‑link to prefilled checkout with a signed token. Expire links quickly.

- Callback handshake: implement server‑to‑server confirmation so the app can immediately reflect entitlements after a web purchase.

- External transaction reporting: wire up Apple’s reporting endpoint for external conversions so your declarations match your revenue. Expect audits. Build dashboards now.

Analytics & finance

- Attribution: set a clear rule for crediting Store Services’ initial assist. Keep web analytics clean with campaign params dedicated to in‑app handoff.

- Revenue recognition: align PSP settlements, App Store statements, and entitlement logs so finance can reconcile monthly without heroics.

- Tax/VAT: confirm your nexus and VAT handling by country. Don’t surprise yourself in Q4.

FAQ developers are asking this week

Can I mix Apple IAP and external payments in the same app?

In the EU storefronts, you can now communicate and link to off‑platform offers, but you can’t present competing payment options for the same transaction within one storefront flow. Most teams pick a primary for each SKU or design clear separation by screen and SKU.

Does the 5% Core Technology Commission apply to web‑only sales?

If a purchase is usable in your iOS app and you’ve promoted it inside the app (e.g., via an actionable link), plan for the CTC to apply. If you purely sell and consume outside iOS without promoting in‑app, your exposure changes—talk with counsel and finance and document the decision.

Is the 2% initial acquisition fee recurring?

Model it as a first‑conversion cost on the Apple‑assisted path for each user, not a recurring take. Your ongoing rate drivers are Store Services and CTC.

What about small developers?

Small Business Program participants see a reduced Tier 2 Store Services rate (10%). If you’re on the cusp of eligibility, model both scenarios before you blow past the revenue threshold.

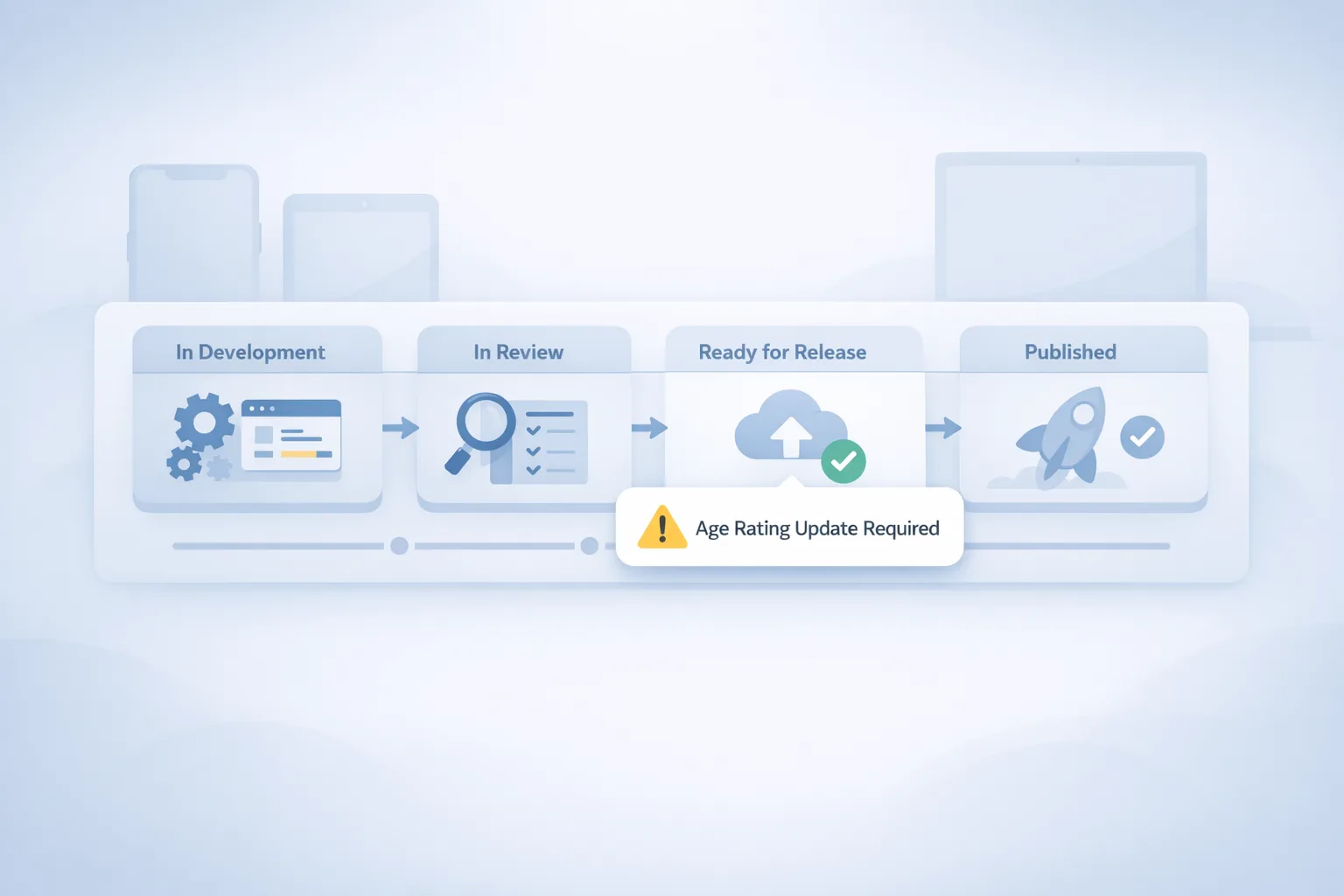

Compliance signals to watch in Q1–Q2 2026

Regulatory pressure isn’t going away. The European Commission’s DMA enforcement has already forced multiple changes to App Store terms and continues to shape what’s allowed and how it’s priced. Expect more guidance and, potentially, more tweaks around alternative distribution, external link UX, and disclosure requirements. If you distribute in Europe, schedule a quarterly review of your App Store compliance and economics alongside your release planning.

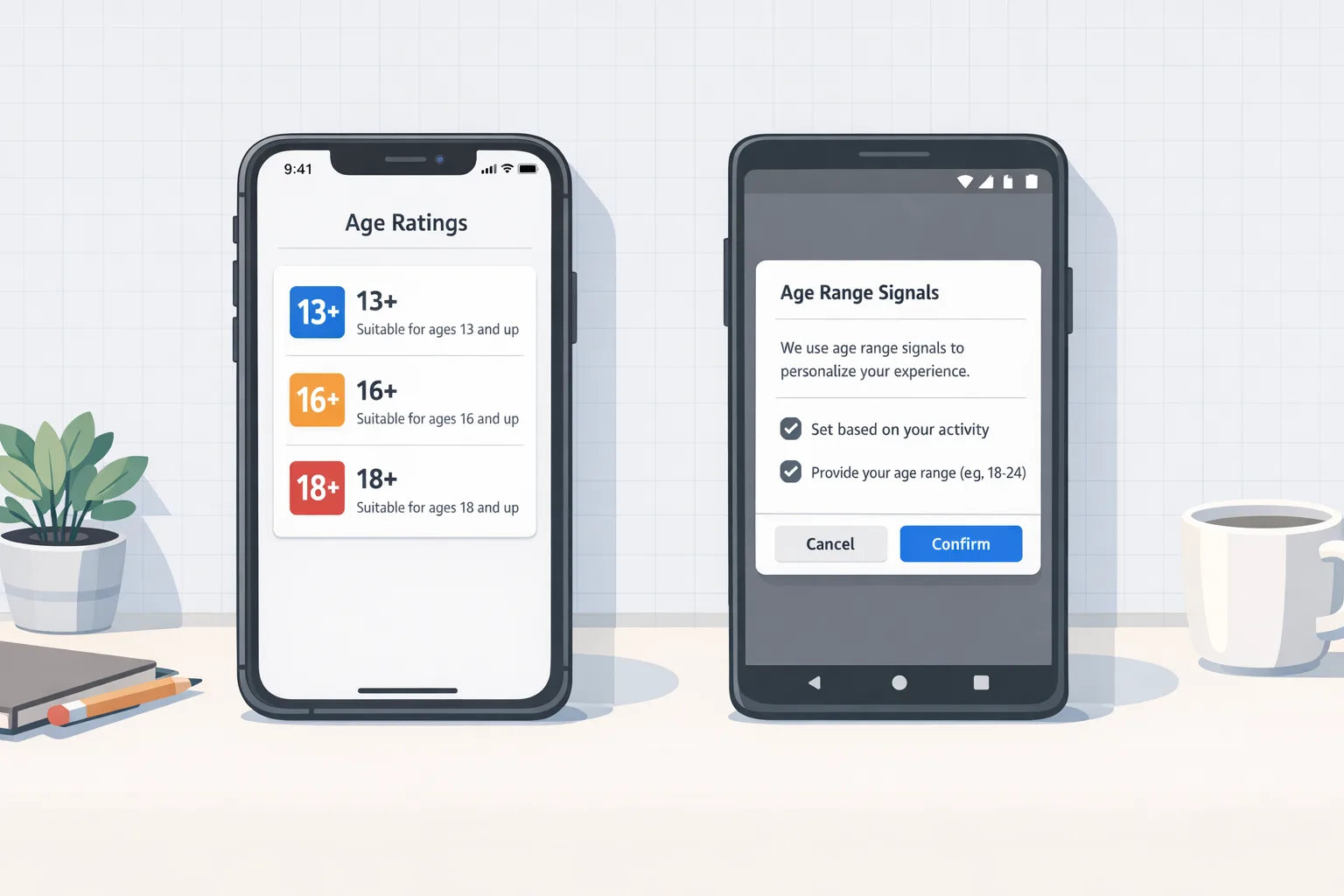

Meanwhile, age‑assurance rules in the U.S. and EU are tightening. If your product has teen or mature features, bring your gating and verification up to standard. Our earlier guidance on building age‑aware flows pairs well with this fees playbook—see the App Store Age Rating 2026 vs. Play Age Signals analysis and the practical UX patterns in Ship a Compliant UX Now.

A simple worksheet for your next pricing review

I use this with clients when we’re deciding between IAP, external links, or a hybrid approach. Copy it into your spreadsheet, plug your actuals, and delete the assumptions you can’t verify.

Worksheet steps

- Define SKUs: list every SKU and price, including trials and bundles.

- Pick a primary flow per SKU: IAP, external link (Tier 1), external link (Tier 2), or reference only.

- Apply platform fees: Store Services %, CTC 5%, initial acquisition 2% (only for first conversion in the external path).

- Add PSP fees for web: % + fixed, by country.

- Add tax: VAT by buyer country; flag exemptions or platform‑handled cases.

- Conversion assumptions: first‑run conversion, return‑to‑complete rate, churn.

- Fraud/chargeback reserve: start with 0.2% until you have your own data.

- Entitlement leakage: estimate a small % of purchases that fail to activate or auto‑renew due to technical issues; budget engineering to reduce it.

- Sensitivity table: ±10% conversion, ±3% fee changes, and +1 VAT point.

Run the table for each country cluster (Eurozone, Nordics, UK) and for new users versus returning users. It’s common to land on different answers by SKU: IAP for low‑AOV consumables, external for annual plans, and reference‑only messaging for student discounts you close via web support.

Gotchas teams miss in the first sprint

• Refunds and reversals: map refund authority and timing across App Store and PSP. Decide who’s the source of truth for entitlement revocation.

• Native messaging: Apple‑compliant copy and flows matter. Don’t ship language that implies you’re steering to evade fees—focus on benefits of account‑based billing, cross‑platform access, and payment flexibility.

• Reporting deadlines: build alerting for missing or mismatched external transaction reports. Don’t let this drift into a quarterly fire drill.

• Grace periods and proration: ensure your web billing can handle partial periods if a user switches plans after starting in‑app.

What to do next

- Run the worksheet across your top three SKUs and decide the primary flow for each by next Monday.

- Prototype external link UX behind a server flag and A/B test copy for 10% of EU traffic.

- Implement the server‑to‑server entitlement callback and the external transaction reporting pipeline.

- Schedule a quarterly EU fees + DMA review with product, finance, and legal.

- If you have teen users or mature features, pair this work with age‑aware UX upgrades using our Play Signals explainer and the compliant UX checklist.

Need a second set of eyes?

If you want help modeling your EU economics or implementing the external purchase flow without breaking your growth loops, our team ships this work for venture‑backed startups and established brands alike. See what we do, explore recent projects we’ve shipped, and reach out via a short brief. We’ll review your SKU map, run the fee math, and give you a tactical plan in a week.

Zooming out, the EU’s DMA isn’t a one‑and‑done regulation. It’s a steady drumbeat that keeps nudging gatekeepers toward more openness—and more granular economics. That’s not a bad thing if you run your numbers, control your funnels, and avoid magical thinking. The developers who win in 2026 won’t be the ones who shout about fees; they’ll be the ones who adapt fast and keep shipping.

Comments

Be the first to comment.