The last days of 2025 delivered a cluster of App Store policy changes with real consequences for how we design consent, distribute apps, and get paid. Italy’s competition authority issued a €98 million fine related to privacy prompts. Brazil struck a settlement that forces Apple to allow third‑party app stores and alternative payments, with implementation due within 105 days of December 23, 2025. Japan’s Mobile Software Competition Act (MSCA) prompted Apple’s announced changes on December 17. And in the U.S., a federal judge in Texas blocked a state age‑verification law on December 23. If you own a mobile P&L, these aren’t headlines—they’re requirements. Let’s translate the noise into action.

What changed this week, exactly?

Three concrete, near‑term levers moved—and one medium‑term lever is now on a clock:

• Italy: The Italian authority penalized Apple for how privacy prompts treat third‑party apps versus Apple’s own. The immediate impact for developers is not a UI change you ship tomorrow, but a clear signal: consent flows will keep drawing scrutiny, and you’ll need airtight rationale for every data request and tracking toggle.

• Brazil: Apple agreed to allow third‑party app stores and alternative payments in Brazil and to implement changes within 105 days of December 23, 2025. Put a date on your calendar: April 7, 2026 is the outside edge. If you have Brazilian users or a LATAM growth plan, you finally have a legal basis to model distribution and payment alternatives in iOS.

• Japan: On December 17, Apple announced iOS changes to comply with the MSCA, including pathways for alternative app marketplaces and payments, along with guardrails Apple says are designed to mitigate fraud and privacy risk. Expect new APIs, review requirements, and security attestations to ship as Apple operationalizes the policy.

• Texas: A U.S. federal judge issued a preliminary injunction halting an age‑verification and parental‑consent law that was set to hit apps and stores in January. The case will move, but for now, nationwide platform rules remain the ceiling for most U.S. apps—buy you time, don’t waste it.

Zooming out, Apple also earlier allowed U.S. apps to include external payment links in certain contexts in 2025. Combine that with Brazil and Japan, and we’re facing a map where payment and distribution constraints vary by market and by feature. That fragmentation is the story for 2026.

Why this matters to your 2026 roadmap

Here’s the thing: even modest policy changes ripple through growth models, conversion funnels, data pipelines, and fraud controls. Over the next two quarters, you’ll be making calls in four areas.

1) Distribution strategy. Third‑party app stores in Brazil and alternative marketplaces in Japan create optionality. Optionality is not automatically value. If your product depends on search placement, editorial features, or tightly integrated updates, Apple’s distribution still may win. But if you monetize primarily outside IAP and your audience is price‑sensitive on fees, alternative marketplaces can unlock margin and local partnerships.

2) Payments architecture. With external payment flows permitted in more places, you’ll weigh Apple IAP against PSPs and your own checkout. Expect a hybrid: Apple IAP for frictionless renewal and Family Sharing benefits; external payments for enterprise or high‑AOV offerings. The right split depends on churn sensitivity and support cost.

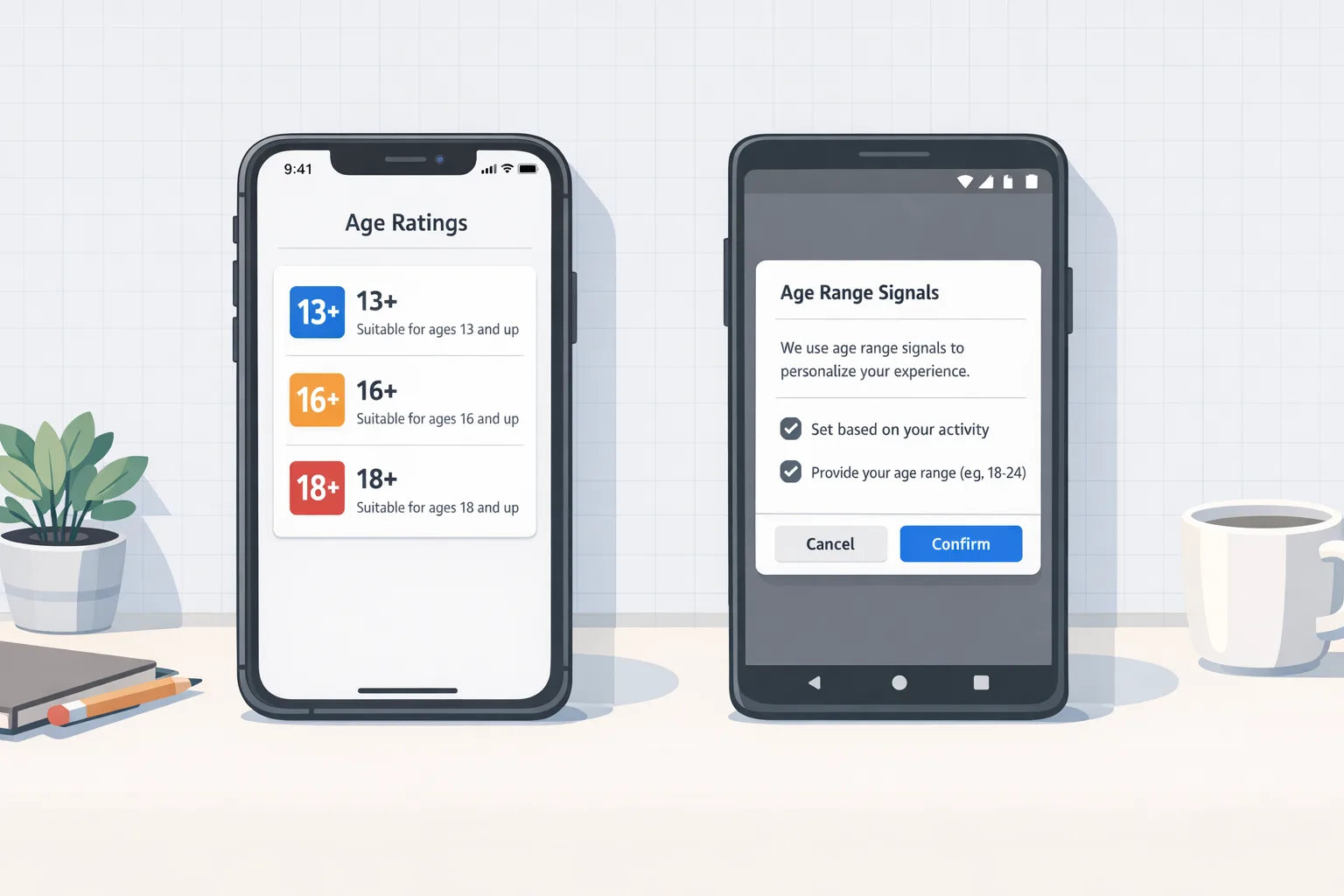

3) Consent and ATT. The ATT policy remains the baseline, and Italy’s action underscores the need to keep consent flows precise, minimal, and evenly applied. If you use any third‑party analytics, attribution, or AI‑adjacent processing of personal data, your disclosures must be clear and pre‑permissioned. Don’t rely on boilerplate.

4) Compliance operations. Country‑by‑country divergence means product ops must look more like tax compliance—central rules with localized overrides. Your release train and feature flags need to handle regional payment, consent, and marketplace toggles without forking the app.

App Store policy changes: the developer playbook

Let’s get practical. Below is a 30‑day sprint you can start on January 2, 2026, organized into four workstreams that ship in parallel. Adjust to your scale, but keep the sequencing.

Workstream A: Consent and data minimization

• Inventory every SDK and data sink. For each, document what personal data is collected, legal basis, retention, and whether it touches third‑party AI or model providers.

• Rewrite your consent copy to be task‑level and outcome‑driven. Replace “for a better experience” with specifics: “Allow us to measure which workouts you complete so we can recommend session lengths.” Short, plain English, and localized.

• Implement dual‑layer controls: a first screen that frames the decision, and a second that lets users toggle categories. Respect opt‑out instantly.

• Log evidence. Store timestamps, texts, and versions of every consent screen shown and accepted. When regulators ask “what did a user see on December 24, 2025?”, you need proof.

Workstream B: Payments architecture and fees

• Build a fee model across three lanes: Apple IAP, external PSP (e.g., Stripe, Adyen), and enterprise invoicing. Include gateway, fraud, chargeback, FX, and tax. On a $100 annual plan, a 15% platform fee versus a 2.9% + 30¢ PSP fee isn’t the whole story—factor refund rates and support load.

• Prototype an external web checkout for Brazil and Japan flows with device handoff. Minimize tab hops. Pre‑fill with on‑device data where policy allows, and fall back gracefully if cookies are blocked.

• Decide when not to externalize. If Family Sharing or Apple’s seamless upgrade path drives retention, keep IAP for those SKUs. Externalize only where margin actually improves net of churn.

Workstream C: Distribution and marketplaces

• Run a Brazil/Japan go‑to‑market spike. Identify the top two alternative marketplaces most aligned to your category. Assess editorial, rating systems, update cadence, malware defenses, and analytics access.

• Assemble a marketplace kit: privacy policy variant, payment disclosures, security attestation, store creatives sized to that store’s specs, and a region‑specific support macro. You want a 48‑hour launch path once APIs open.

• Implement a portable update channel. Users must receive timely security and critical‑bug fixes regardless of where they installed your app. If a marketplace lags, build in‑app nags and a safe, policy‑compliant migration link back to your primary distribution.

Workstream D: Security, verification, and rollback

• Treat new payment and marketplace code paths as high‑risk. Require security reviews, add runtime checks, and log abnormal install contexts.

• Adopt a “patch, verify, repeat” cadence for your mobile release train. We’ve used this rhythm in web stacks through incident cycles; it applies here too. If you need a model, our recent security notes on patching and verification outline the cadence teams can adopt year‑round—use the practical checklists in this holiday patch reality check and the rapid rollout techniques in how to prove fixes fast.

• Add kill switches for regional features. If a marketplace integration misbehaves or a regulator clarifies a rule mid‑launch, toggle it off without shipping a new binary.

People also ask: common questions, straight answers

Do I still need ATT prompts if I move to external payments?

Yes. ATT applies to tracking, not payments. If you or your partners track users across apps and websites, you must request permission and respect “Ask App Not to Track.” Payment choices don’t change consent obligations.

Will third‑party app stores in Brazil and alternative marketplaces in Japan bypass Apple’s review?

No. Expect different review and security processes, not no process. Apple has telegraphed additional safeguards in Japan tied to fraud and privacy risk. Third‑party stores will have their own requirements. Your compliance workload goes up before it goes down.

How do I handle users who install from a marketplace but want to upgrade via Apple IAP later?

Design for parity and clarity. If a user installed via an alternative store, keep upgrade messaging neutral and transparent about where billing is processed. Avoid dark patterns that push them to a single payment path. If you mix IAP and external payments, make refund and support flows obvious.

Should my startup launch its own checkout or stick with Apple IAP?

Run the numbers. Below is a quick, directional model on a $120 annual plan with 10,000 subs in Brazil:

• Apple IAP at 15%: $18 per user in fees. High conversion, lower support, Family Sharing benefits.

• PSP at 2.9% + 30¢, 1.5% FX, and 0.6% fraud/chargebacks effective: about $5.94 + $0.30 + $1.80 = $8.04 per user, but expect lower conversion on web handoff and more support. If conversion drops 8–10% versus native, the fee savings can vanish.

Run A/B tests with real traffic in the region before a full switch. Don’t guess.

Data points and dates you can plan around

• December 17, 2025: Apple announced iOS changes for Japan under the MSCA, including alternative marketplaces and payments with added safeguards.

• December 23, 2025: Brazil settlement approved; Apple must implement third‑party app stores and alternative payments within 105 days.

• April 7, 2026: Target outer date for Brazil changes to be live based on the 105‑day window.

• December 23, 2025: Texas age‑verification law preliminarily enjoined by a federal judge.

• May 2, 2025: Apple updated U.S. App Review rules to allow certain external payment links, following court directives.

Use these dates to pace feature flags, legal reviews, and QA.

A lightweight governance model that won’t slow shipping

You don’t need a policy bureaucracy to stay compliant. You need three recurring meetings and one dashboard.

• Monday 30:30 (30 minutes, 30 items max). Cross‑functional standup: legal, product, engineering, growth. Review diff since last week across policy trackers, consent copy, and regional feature flags. Decide, don’t discuss.

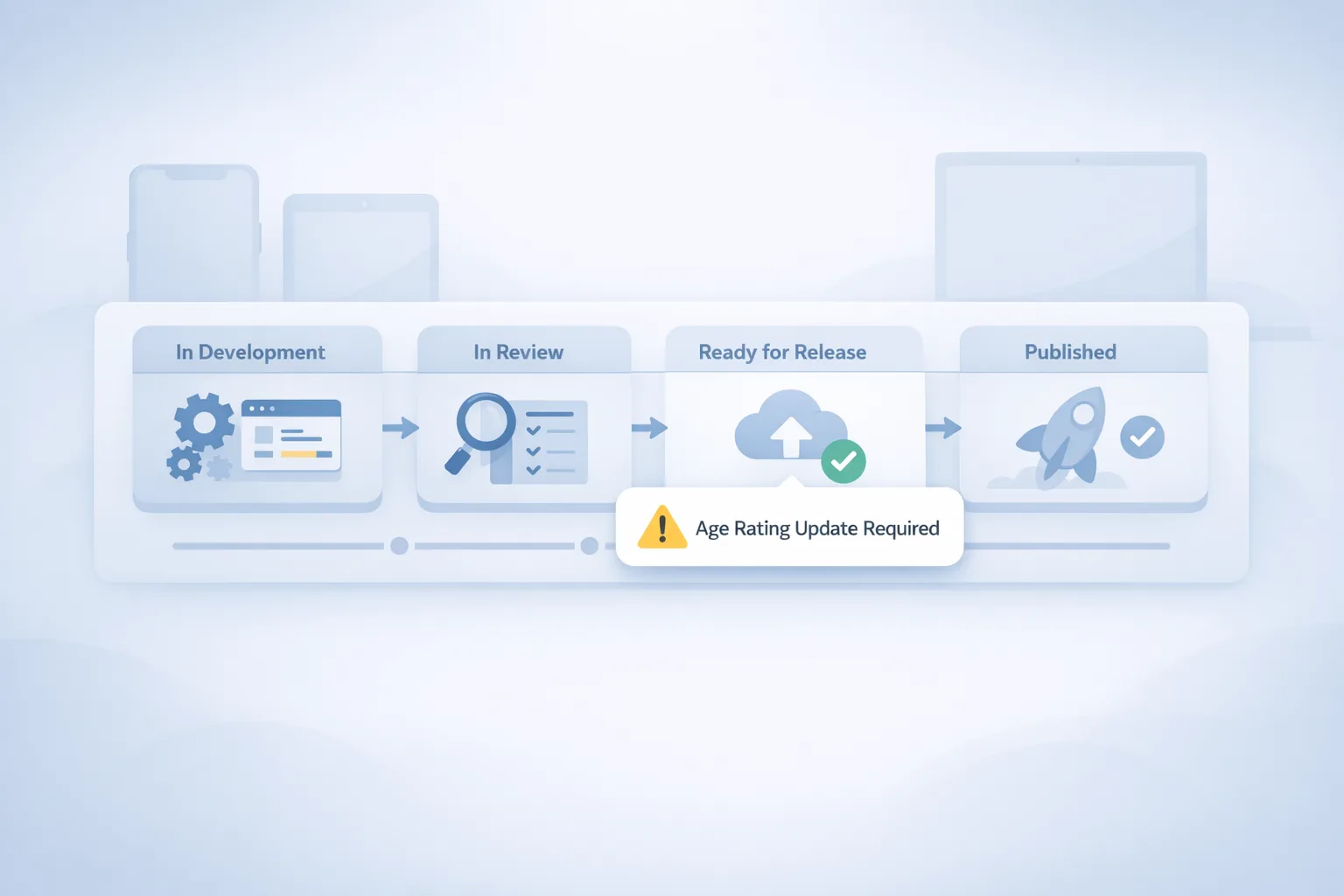

• Release Readiness (45 minutes, mid‑sprint). Demo consent screens and marketplace flows with real devices. Legal signs off on exact strings. Save screenshots/version IDs to the release ticket.

• Post‑launch Audit (25 minutes, 7 days post‑release). Compare production telemetry to pre‑launch assumptions: consent acceptance, payment conversion, refund/chargeback rates, and marketplace update latency. File deltas as backlog items with owners.

• Dashboard: One page that shows country toggles, SDK inventory, consent copy versions, payments routing by SKU, and alerts for any app store submission rejections. If an executive can’t see risk in 60 seconds, the dashboard isn’t working.

Security pitfalls as policies loosen

Policy liberalization tends to increase attack surface. Third‑party marketplaces and external payment flows introduce new failure modes: counterfeit updates, credential stuffing on web checkouts, malicious SDKs injected through supply chain, and region‑specific phishing that mimics your checkout handoff.

Countermeasures you should implement now:

• Pin marketplace endpoints and verify signatures. Don’t accept arbitrary update URLs. Monitor for mismatched signing identities.

• Require device attestation for login and checkout in high‑risk regions. If attestation fails, degrade gracefully and validate with a second factor.

• Lock down CI/CD with per‑region secrets and short‑lived tokens. Never reuse production keys across marketplace builds.

• Adopt the simple “patch, verify, repeat” drumbeat across mobile just as you do on web. If you want a practical approach you can lift, our clients start with the short action plans in this post on proving fixes and align release engineering with an auditable trail. If you need help implementing, our services team runs compliance sprints that pair engineers with product and counsel.

A quick decision tree for 2026

Ask three questions for each region and SKU:

• Distribution: Will an alternative marketplace materially improve discovery or margin without compromising update velocity or security? If yes, pilot; if no, stay in the main store.

• Payments: Does external checkout improve gross profit after realistic conversion and support assumptions? If yes, route; if no, keep IAP.

• Consent: Can we legitimately claim we need this data to fulfill the product value in that region? If no, drop the collection or make it opt‑in with clear benefits.

What to do next (developers and business owners)

• Developers: Build feature flags for Brazil and Japan payments/marketplaces by January 15. Add consent logging and screenshot capture to your release process. Integrate device attestation for checkout flows.

• Product: Rewrite consent copy and experiment with two shorter variants. Define success metrics for external checkout that include churn and support tickets, not just fee savings.

• Legal/Compliance: Prepare localized privacy notices for Brazil and Japan. Draft a playbook for handling store rejections and regulator inquiries. Establish a retention policy for consent logs.

• Leadership: Allocate budget for marketplace pilots and fraud tooling. Approve the Monday 30:30, set the dashboard as a weekly readout, and commit to revisiting the model in April 2026 when Brazil’s timeline matures.

Final thought

Policy change is rarely about winners and losers; it’s about teams that trade uncertainty for prepared options. The developers who will outrun 2026 aren’t the loudest—they’re the ones who already have a toggle, a test plan, and a consent screenshot ready to go. If you want a partner to move fast without drama, see what we build in our portfolio, explore how we work on what we do, and keep an eye on our blog for hands‑on playbooks as the rules evolve.

Comments

Be the first to comment.