Q1 2026 App Store Policy Changes: Field Guide

Two policy fronts will define mobile monetization early this year: Google Play’s U.S. rollout of an external content links program and alternative billing requirements with new fees by January 28, 2026, and Apple’s Brazil settlement that opens iOS to third‑party app stores and external payments on a 105‑day implementation clock. If you own a P&L or ship releases, these app store policy changes will alter your roadmap, checkout flows, and revenue share math. Let’s cut through the noise and get your team moving.

What changed on Google Play (U.S.)—and what it costs

Google has introduced two intertwined programs for U.S. users: external content links and alternative billing. Both require enrollment and API integration, and both can carry service fees even when transactions occur outside Google Play. There’s also a hard date: January 28, 2026 is the compliance deadline for apps that want to link out or use non‑Google billing in the U.S.

External content links cover two use cases: linking users out to complete purchases on the web and linking users to download an app outside Play. For purchases, Google lists a required ongoing service fee around 10% on successful conversions, with an optional add‑on that can bring effective rates closer to 20% for in‑app purchases; subscription add‑ons typically sit lower (often closer to 10–13% depending on tiering). For links to downloads, Google applies a fixed per‑install fee when an install happens after a user clicks your link; indicative U.S. rates discussed publicly are roughly $2.85 per app and $3.65 per game if the install occurs within a defined window after the click. The exact program tier you select and what Google counts as a qualifying install or conversion will determine your final effective rate.

Alternative billing is separate but related. Choosing a non‑Google processor for in‑app purchases doesn’t zero out fees—you’ll still owe a platform service cut. The headline takeaway: you can control user experience and payment costs, but the platform will still collect for distribution, review, and security features. Plan for this in pricing and revenue recognition.

Operational implications for Android teams

You’ll need to enroll in the relevant program(s), integrate Google’s APIs to declare links and report transactions, and support dispute resolution and refunds for off‑Play purchases. If you link to downloads, you must register external apps and keep them reviewed and up to date. Your legal and support teams should be ready for new disclosures and user communications around billing choice.

What changed on iOS—in Brazil—after Apple’s settlement

In Brazil, Apple agreed to allow third‑party app stores, to permit external payment links and third‑party payment processors presented alongside Apple’s, and to use neutral, objective warnings. Apple has 105 days from the agreement’s homologation to ship these changes, with non‑compliance carrying significant fines. The settlement is set to run for several years, with monitoring baked in.

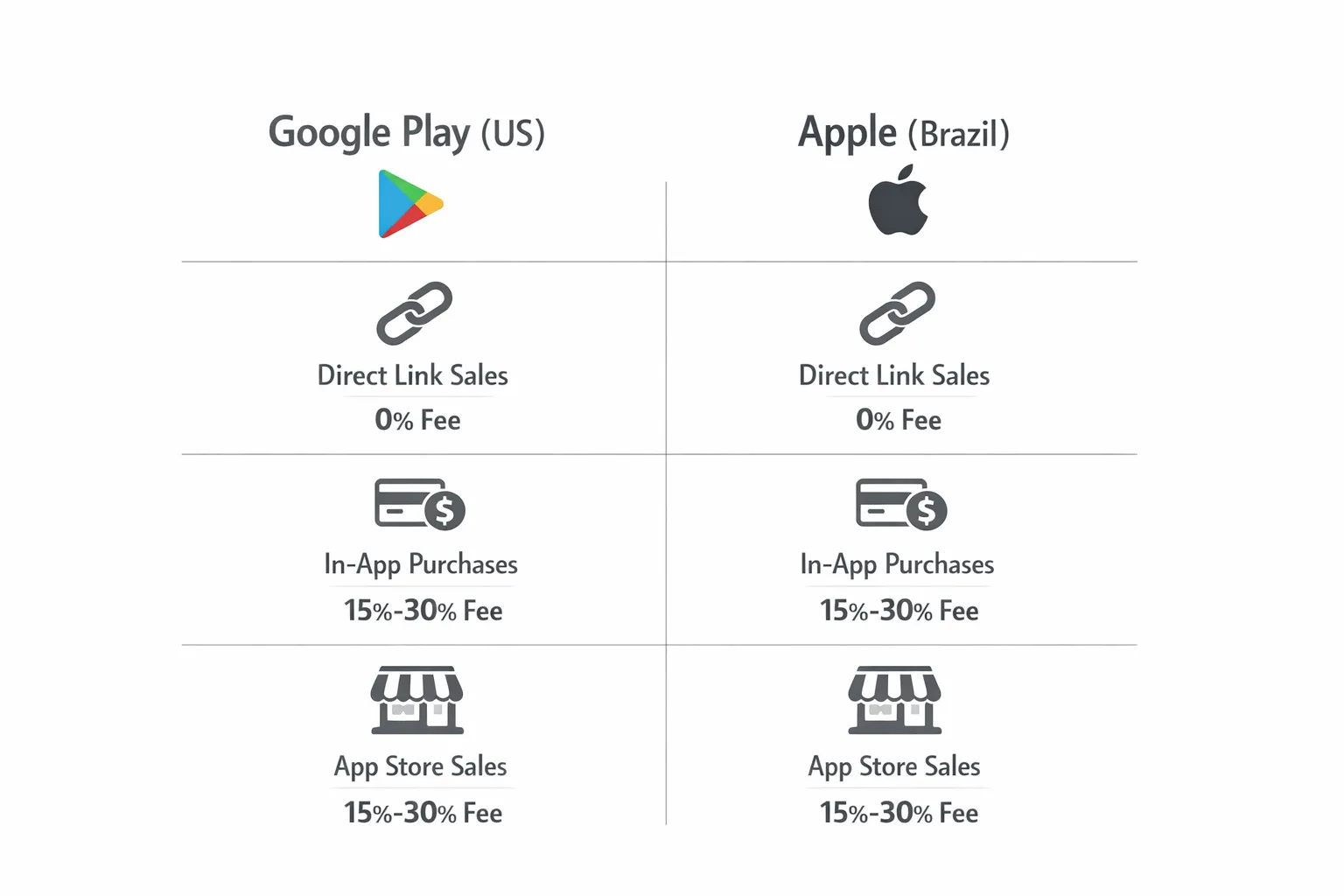

Apple also defined a new fee scheme for the Brazilian market that preserves commissions while opening distribution:

- Standard App Store commission bands remain roughly 25% (general) and 10% (for small‑business program qualifiers).

- Using Apple’s own payment processing adds a 5% processing fee.

- Apps that include a clickable link or button taking users to an external website for payment face a 15% commission applied to the transaction.

- Text‑only references to external offers (no link or button) can avoid the link fee, according to the published details.

- Alternative app stores will pay a 5% Core Technology Commission reflecting platform services.

For Brazilian users and developers, this is a structural change: the distribution channel broadens, but economics depend on how you route users through links, processors, and stores.

Who’s affected—and when do you actually need to act?

If you’re shipping in the U.S. on Android and you link to web checkouts or external downloads, January 28, 2026 is your line in the sand. Enroll, integrate, and test before then, or strip links to avoid non‑compliance. If you sell subscriptions, expect a lower effective rate than one‑time in‑app purchases, but still account for service fees. If you plan to steer users to sideload app updates or new installs, model the per‑install costs against your paid acquisition and organic funnels.

If you operate in Brazil on iOS, work backward from a window that lands in late March to early April 2026 for Apple’s implementation. Begin experimentation with how prominently you place external links, whether to keep links as text‑only in some flows, and when to build for third‑party stores versus the main App Store. Build neutral, objective warning UX that aligns with Apple’s guidance to avoid rejections.

The economics: which path is cheaper for your app?

Here’s the thing: there’s no universal winner. The "cheapest" option depends on your pricing, conversion rates, catalog, and support overhead. Use this simple framework to compare options for each market and SKU.

1) Map your per‑transaction take rate

For Android (U.S.), start with your baseline Play Billing rate. If you use alternative billing, plug in the platform’s service percentage for your tier (e.g., about 20% for many one‑time IAPs; around 10–13% for subscriptions depending on configuration). If you use external content links to web checkout, apply the ongoing service percentage to successful conversions. If you link to downloads, add the per‑install fixed fee for installs attributed to your link. Don’t forget an initial acquisition component may apply for conversions within six months of a Play‑managed install.

For iOS (Brazil), if you stay entirely inside Apple’s flow, your rate is the standard 25% (or 10% for small businesses) plus 5% if using Apple’s processor. If you include a web checkout link or button, plan for a 15% link fee applied to the external transaction; if you keep it text‑only, you can avoid that link fee on those flows. For alternative app stores, pencil in a 5% Core Technology Commission and negotiate distribution, marketing, and support overhead with your chosen store.

2) Model funnel drop and support costs

External links add steps. Expect some drop between your app and a web checkout (extra taps, sign‑in, payment form friction). On the flip side, web checkout lets you use your preferred processor, reduce fraud costs, and run promotions freely. Assign a realistic conversion delta. A 5–15% drop can erase a few percentage points of fee savings quickly; model it.

3) Price to absorb volatility

With variable service tiers and per‑install fees, price bands matter. Many teams will experiment with ensuring popular items land on psychologically durable price points ($4.99, $9.99, $19.99) while keeping margins after platform fees and payment costs. Use bundles to shift value into lower‑fee items (e.g., subscriptions vs. one‑offs on Android) or text‑only promotions (on iOS Brazil) when it makes sense.

How to implement without derailing your sprint plan

You don’t have to boil the ocean in January. Ship the minimum to comply and test, then iterate. Here’s a 30‑day execution plan you can hand to your engineering and product leads this week.

Week 1: Enrollment, legal, and architecture

- Android: Enroll in external links and/or alternative billing. Capture program IDs, read the API docs, and confirm transaction reporting requirements and review timings. Decide if you’ll support both checkout routes.

- iOS Brazil: Align legal with the settlement requirements. Draft neutral, objective warnings. Decide where you’ll use text‑only references vs. clickable links. Identify third‑party stores to pilot (if any) and technical requirements for their SDKs or signing.

- Finance: Create new ledger codes for off‑store transactions to keep fee auditing clean. Prep dashboards that separate platform service fees from processor costs.

Week 2: Build the pipes

- Android: Integrate link declaration and transaction reporting APIs. Build the consent/info screens Google requires before a user leaves your app. Implement receipts and refund pathways for off‑Play purchases.

- iOS Brazil: Add link/button variants, a text‑only variant, and your payment processor SDK (if using one). Implement the neutral prompts. Add tracking to attribute external purchases by campaign and placement.

- Both: Instrument analytics to compare on‑platform vs. off‑platform funnels, including abandonment reasons.

Week 3: Pricing and experiments

- Run A/B tests: link prominence, web checkout UX, and price points that preserve margin after fees.

- Define guardrails: stop experiments that underperform by more than a set margin loss (e.g., -2% contribution or worse).

- Forecast: Update contribution margin per SKU by region with live data.

Week 4: Prepare for reviews and scale

- Android: Submit external apps (if linking to downloads) for review, validate 24‑hour install attribution and reporting, and test support playbooks for disputes.

- iOS Brazil: Package screenshots for review showing neutral language and compliant flows. Document your text‑only placements.

- Update your storefronts and CRM: clarify where users can manage subscriptions and request refunds for cross‑channel purchases.

People also ask

Do I have to integrate Google’s APIs if I only add a simple external link?

Yes. If you participate in the external links program, you’ll declare links, show Google’s required information screen, and report qualifying transactions within the specified time window. Treat this like a first‑class integration with its own monitoring and alerting.

Can I avoid Apple’s 15% link fee in Brazil by using text‑only messaging?

Yes, for flows that mention an external offer with static text (no clickable link or button). If you add a link or button that takes users to a website for payment, the link fee applies. Many teams will build both variants and route high‑margin products through text‑only placements.

Will these changes roll out beyond the U.S. and Brazil?

For Google, similar programs already exist in the EEA with their own structures and currency tables; the U.S. specifics may continue to evolve with court oversight. For Apple, the settlement applies to Brazil, while other regions follow their own laws and ongoing regulatory processes. Watch for updates, but plan region‑by‑region.

How these app store policy changes hit product, marketing, and data

Product will carry the integration and UX burden; marketing will own the funnel and conversion story; data will reconcile reported platform events with your own. Build these alignment points now:

- Attribution rules: Agree on when a transaction is counted under a platform’s ongoing service fee vs. direct web revenue. Document your definitions and share with finance so margins are comparable.

- Auditable logs: Keep immutable event logs of external‑link clicks, installs, and checkouts to resolve disputes or audits.

- Refund routing: Users shouldn’t bounce between your support and platform support to resolve issues. Make refund ownership obvious.

- Offer governance: Create a lightweight process to approve pricing and discounts by region and channel so you don’t accidentally invert margins.

Risk, edge cases, and how to avoid self‑inflicted wounds

There’s a catch with external links: confusion. Users who don’t recognize they’re leaving the store abandon carts. That’s solvable with crisp copy and predictable UI patterns. Another edge case: handling free trials. If you use web trials that convert later, ensure you’re reporting zero‑dollar events properly where required and reconciling when trials roll into paid.

For iOS Brazil, be strict about neutral messaging. Anything that feels like friction or dark‑pattern dissuasion risks rejection. For third‑party stores, vet update cadences, SDK quality, malware screening, and child‑safety features. Operationally, ensure code signing and entitlement handling don’t create brittle release pipelines across multiple stores.

What to do next (this week)

If you need the TL;DR action list, here it is.

- Decide your paths: For Android, pick external links, alternative billing, or both. For iOS Brazil, decide where to use text‑only promos, clickable links, or third‑party stores.

- Set margin floors: Define contribution thresholds that any new flow must hit after platform fees and processor costs.

- Book a sprint: Allocate one squad for integrations, one for checkout UX, and one for analytics/finance dashboards.

- Prepare review packages: Screens, flows, and copy that demonstrate compliance (neutral notices, accurate disclosures).

- Run a 7‑day pilot: Ship to 5–10% of U.S. Android traffic and a Brazil iOS cohort; measure revenue per session and support tickets.

Resources and deeper dives

We’ve been guiding clients through exactly these decisions. If you want a step‑by‑step upgrade blueprint for modern web stacks, see our 30‑day Next.js 16 + React 19 plan. Need the executive brief for leadership? Share App Store Policy Changes: What to Ship by Q1 2026. For Android pricing mechanics and rollout details, read Google Play’s New Linking Fees: What to Do Now. And if Brazil is on your roadmap, bookmark Apple’s Brazil App Store Changes: A 105‑Day Plan. When you’re ready to execute, talk to our team and we’ll help you ship safely.

Final take

This isn’t about picking sides in a platform fight. It’s about shipping reliable revenue. For Android in the U.S., the decision is less “Do we pay a fee?” and more “Which fee structure supports our funnel and CX?” For iOS in Brazil, you finally get distribution options, but you’ll pay in different places based on links, processors, and stores. The teams that win in Q1 2026 will treat these as product levers, not legal footnotes—testing, pricing, and instrumenting with the same rigor you bring to features. Do that, and these changes become a growth plan, not a tax.

Comments

Be the first to comment.