Have you ever looked at your startup's balance sheet and dreamed of finding that hidden vault of real-world assets, like real estate deeds collecting dust, invoices chasing payments, or even carbon credits waiting to be cashed in? Blockchain promises trillions in tokenized gold. As a founder who's had to make do with little money, I've felt that pain: Traditional finance is holding you back when all you want is smooth streams that connect your ideas to billions. But what if Layer 2 magic like Plume Network could turn that anger into energy? This is what it looks like: RWAs were turned into tokens overnight, AI agents managed yields around the clock, and programmable data flowed like a digital river. Your empire not only survived, but it also thrived. In the Web3 whirlwind of 2025, Plume isn't just hype; it's the bonanza builders want, with compliant, scalable tools that scream revenue growth and create real-world value. At BYBOWU, we've seen founders go from having pipe dreams to making money with similar stacks, like Next.js fronts feeding Laravel backends with blockchain hooks. Why is this important? Your tokenized tomorrow starts now, and Plume is the place to start. Get ready; we're going into the builder bonanza that is changing the rules of Web3.

The RWA Revolution: How Tokenized Assets Can Help Your Startup Succeed

Real World Assets (RWAs), like tokenized real estate, commodities, or private credit, are no longer science fiction. They are the trillion-dollar bridge from old ledgers to liquid DeFi dreams. In 2025, tokenized assets will be worth $29 billion (or $307 billion if you count stables). Companies like BlackRock are starting to invest in ETFs, but what about startups? You're ready to jump right in, breaking up equity or yields to get global capital without having to go through a VC. I've been there, trying to sell a green energy side business and getting buried in paperwork. Plume changes that by making tokenization as easy as a no-code zap.

Why the rush of feelings? As a business owner, RWAs mean that funding is open to everyone: Tokenize your future SaaS revenues, let small investors buy in, and see leads turn into cash overnight. Plume's modular L1 is great here; it has already tokenized $4.5 billion across 144 assets, from $1 billion in mineral rights to $200 million in carbon credits. It's not just tech; it's freedom—changing "wait and see" into "build and bank." For lead-gen professionals, think of RWAs as collateral in DeFi loans that send you money to use for your next campaign. We add these to React Native apps at BYBOWU, which lets mobile users stake tokenized plots on the go.

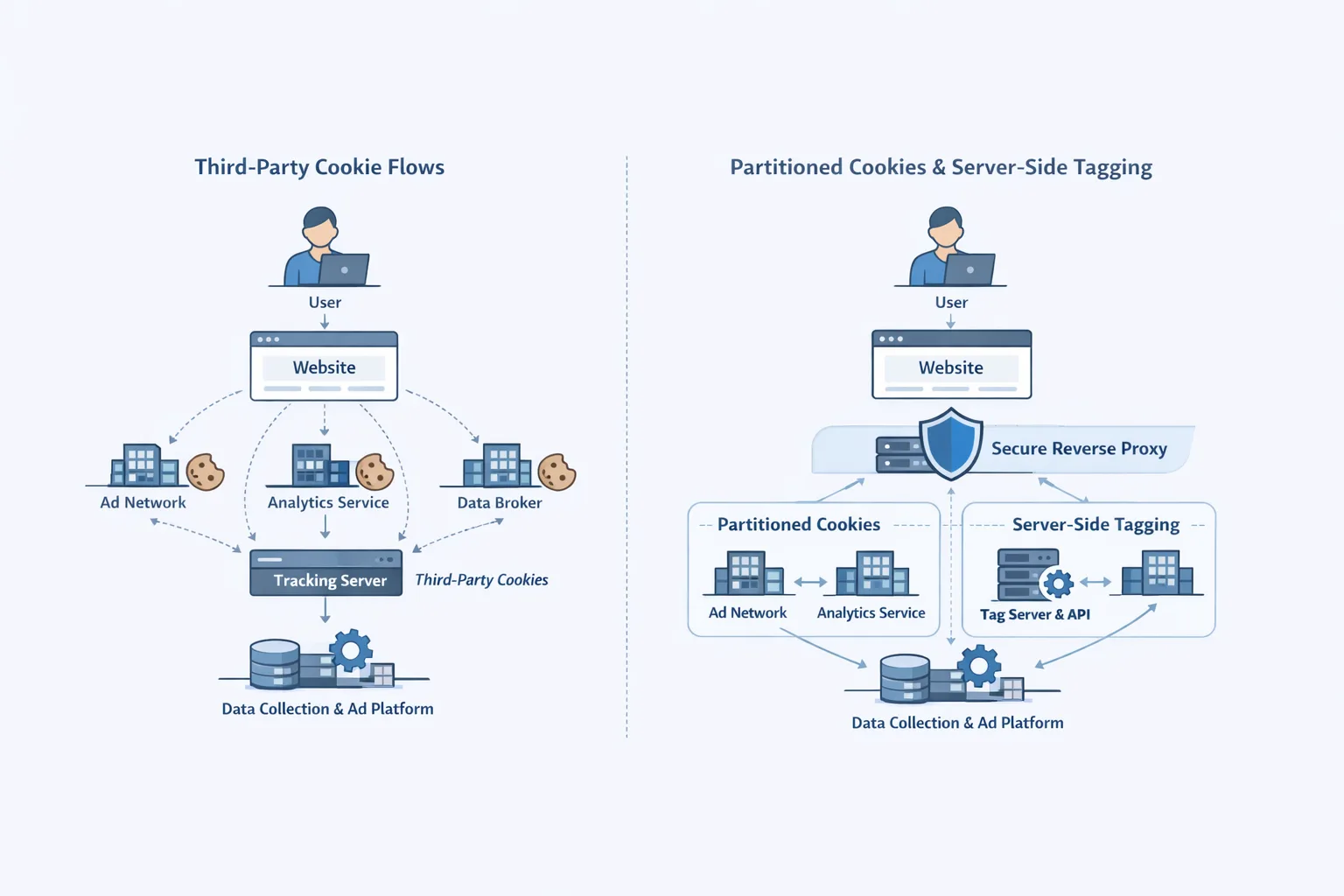

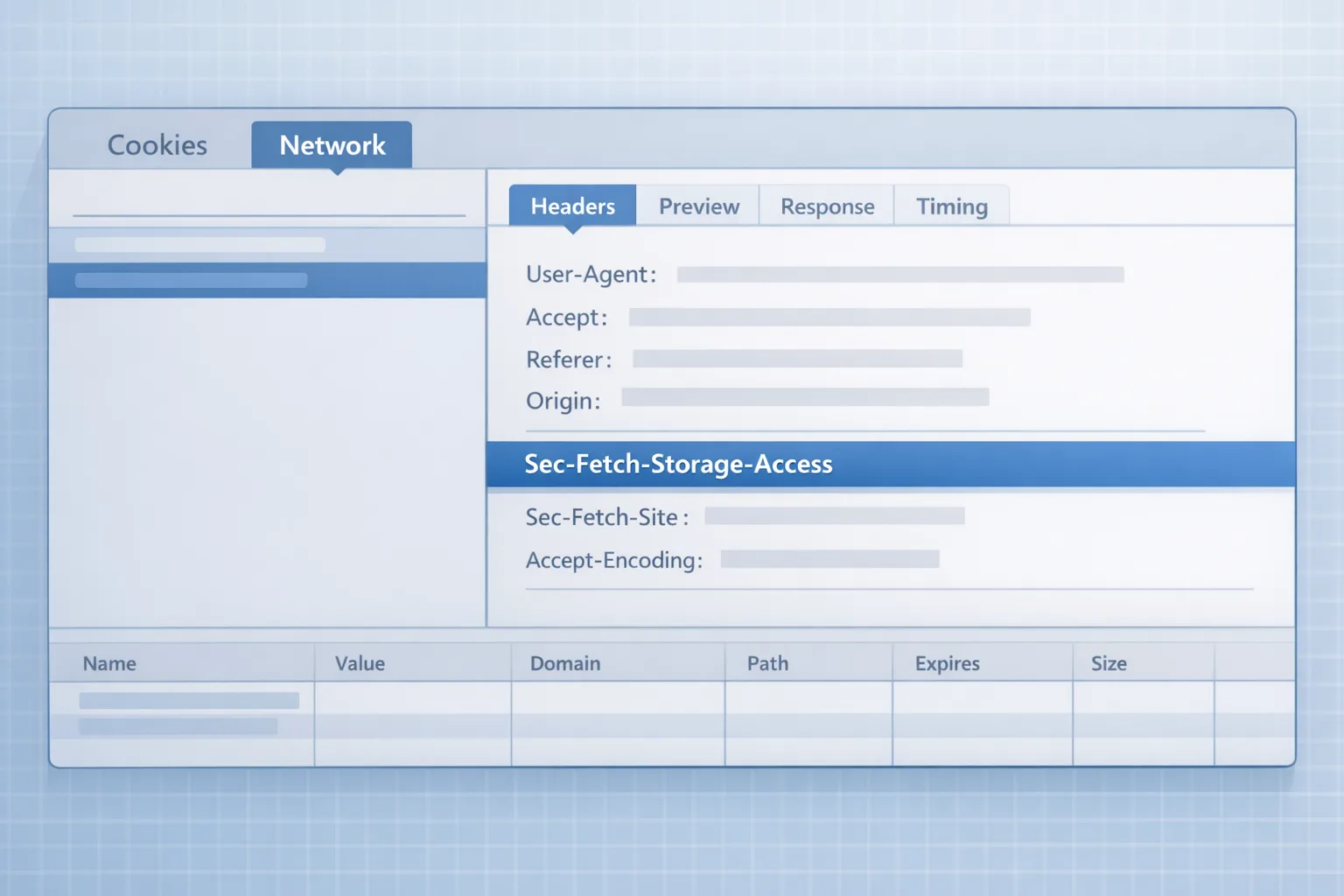

This bonanza also includes programmable data: Oracles like Chronicle make sure that nodes are independent and redundant, which lowers the risk of manipulation with staked nodes and anomaly detection. No more oracle outages that hurt your yields—just streams that can't be tampered with that run 24/7. Why settle for assets that aren't moving when Plume makes them move?

Plume's Layer 2 Magic: Connecting Blockchain to Millions of People

Layer 2 solutions promised scalability, but Plume delivers destiny—a full-stack EVM-compatible chain laser-focused on RWAs, with mainnet live since April 2025 and TVL exploding from $44M to $238M. Haun Ventures and Galaxy have put in more than $30 million, so this isn't just another generic L2. It's RWAfi royalty, which means you can tokenize treasuries or art without worrying about SEC rules. As a founder, that means your tokenized empire grows smoothly. You can get cross-chain yields by sending SkyLink to ETH or SOL wallets, and there are no bridges that slow down your billions.

Let's be honest: What are T+2 settlements in traditional finance? A laughable lag. Plume's Proof of Representation consensus links security to asset value, punishing bad actors and rewarding authenticity. Your tokenized bonds earn interest 24/7 and can be programmed to automatically compound. I've told teams that RWA pilots failed because of oracle failures. Plume's Nexus Highway sends real-time data, changing "what if" into "watch this." For people who want to make money, it's gold: Like Plural Energy, you can break up a $300 million solar farm into smaller pieces and earn 13–20% APY in DeFi.

This Layer 2 isn't separate; it has more than 180 protocols on board, so your RWAs fit together like Lego. Morpho lending has collateral, and Nest DEX has liquidity. How do you feel? It's empowering to see your startup's assets alive and earning money, connecting blockchain isolation to global streams. BYBOWU's AI solutions add an extra layer on top to automate yield optimizations and give you an edge.

AI Agents Unleashed: Programmable Intelligence for Your Tokenized Realm

AI agents in Web3? Once buzzword bingo, now bonanza boosters—autonomous bots on Plume's rails that evaluate risks, optimize trades, and allocate capital at machine speed. Imagine GAIB AI tokenizing infrastructure revenue with AID/sAID tokens, with compliant yields of 15% APY and $150M caps. Your startup's data becomes programmable, and agents do due diligence that used to take months. Why the excitement of the founder? Agents make passive RWAs active: An oracle tweak finds yield spikes, automatically loops into lending, and compounds your revenue while you sleep.

This may sound like something from the future, but PlumeXBT's live: Agents are using Nexus feeds for RWAfi smarts, which cuts costs by 50% to 70% by putting verification right into the code. From my point of view: A client's tokenized credit fund was stuck on manual audits, but agent integration through Plume sped things up—decisions were made in hours instead of months. Agents personalize for lead-gen empires: Tokenized equity NFTs that are customized for each investor's profile, with conversions skyrocketing.

Programmable data seals the deal: Chronicle's redundancy and staking make sure everyone is responsible, nodes are cut for skews, and data flows without being tampered with. It's the emotional anchor: Don't trust suits, trust code. We use Laravel APIs to connect these agents to Next.js dashboards that show off your tokenized successes.

Tokenization Tools That Make Your Dreams Come True

Plume Arc is a no-code tokenization engine with more than 50 modular features for RWAs, such as KYC wrappers and custody hooks. It cuts setup time from months to days. Issuers upload assets, Arc takes care of compliance, and developers add to ERC-3643 so that assets can be issued again. Metadata is hashed on IPFS. As a hustler who started with nothing, this hits: Tokenize the IP in your freelance portfolio and split it up to get passive income—money without having to pitch all the time.

Smart Wallets make things smarter: No gas, built-in identity, enforcing rules while allowing stakes in DeFi. The privacy layer of Nightfall? ZK for institutional RWAs, scaling secrets without letting them out. Practical pivot: A fintech we worked with tokenized $500 million in credit through Credbull. Agents were automatically verified, yields were streamed across chains, and leads were up 25% just from being open about it.

The Global RWA Alliance makes things bigger: WisdomTree, DigiFT, and Morpho are coming together to set standards, and liquidity is going through the roof. Why stay in the past when Plume's tools can tokenize your empire right now? It's the builder's bonanza: cheap, legal, and huge.

BYBOWU's Web3 Forge: Making Tokenized Wins with Plume Power

In our US studio, Plume's stack works perfectly with our Next.js and React Native tools to make hybrid apps where users mint RWAs on their phones, agents optimize in real time, and Laravel syncs off-chain data. We turned client pilots into tokens: A $120 million Medicaid claims vault through Medex, with programmable yields for automatic redemptions and revenue sent to growth. How much? Cut by 60% using Arc's no-code.

It's heartfelt: Founders we help get excited when agents cut back on due diligence, programmable data unlocks yields, and "stuck in silos" turns into "streaming billions." Check out our portfolio for RWAfi realms we've come up with, mixing Plume with AI for lead-gen lore.

What makes us different? Relatable roots: I've chased tokenized dreams without tools; now we offer bonanzas that connect your blockchain to boardrooms, with prices that are clear for bootstraps.

Real-World Wins: Founders Building Empires on Plume's Rails

Meet Elena, an expert in wellness startups: Tokenized equity through Arc, agents through GAIB handling yields—raised $2 million in small amounts, and leads from small amounts of fame are up 35%. What did she say? "From VC voids to value streams—Plume's programmable paradise."

Or Raj's rush to get more renewable energy: $300 million in solar tokens, SkyLink streaming across chains, and Nightfall privacy shielding IP—money goes back into research and development, and the empire stays strong. Plume's $8B Day 1 assets show that RWAs spark innovation, so these aren't outliers. I have lived similar lives: Early Web3 bets went up in flames on bad bridges. Plume's bonanza builds bridges that last, turning problems into cheers.

Getting Through the On-Chain Odyssey: Tips for Smooth Streams

Tokenization traps? Regulatory problems and data shortages—Plume gets ahead with Arc's 50+ guards, and Chronicle's redundancy cuts down on skews by 99.9%. This may sound like a lot, but break it down: Create a credit tranche prototype, use SDK to do an agent audit, and SkyLink to deploy across chains.

For developers, use factories to issue more; for founders, use Alliance to get more liquidity. We've helped clients get through everything from oracle outages to oracle overhauls. BYBOWU's services make it more efficient and cost-effective so you can focus on flows instead of fixes. Pro tip: Stake $PLUME for governance—your voice in the bonanza.

2025 Horizons: RWAs, Agents, and the Trillion-Dollar Wave

Looking ahead, Plume's fusing deeper: AI agents like PlumeXBT automate RWAfi and ZK for privacy-scaled streams. SEC agrees to be a transfer agent? A plan for billions of compliant tokens. For revenue rebels, it's heaven: RWAs powering DePINs and agents always looking for ways to make more money.

One surge: Mira Protocol's data symbiosis and verifiable analytics that power tokenized trusts. Plume doesn't follow the tides; it controls them. Your empire will last forever.

Start Your Legacy: Tokenize with BYBOWU and Plume Now

We've taken apart the bonanza: Plume's Layer 2 lighting RWAs, agents bringing data to life, and programmable streams that can reach billions. This isn't just a Web3 fantasy; it's your huge, compliant tokenized empire that's ready to boost sales and leads.

Why wait for waves when you can surf them? At BYBOWU, we make paths powered by Plume, which are custom tokenizers that mix AI with your stack. Check out our portfolio for tokenized stories, or get in touch to plan your bridge. Launch today—your billions are waiting.

Comments

Be the first to comment.