Google Play Link Fees + iOS Brazil: Ship by Jan 28

If you sell apps in the U.S. or ship to Brazilian iPhone users, you’ve got real deadlines. The Google Play external offers program and external content links now include Google Play external link fees and tracking rules, with a U.S. compliance date of January 28, 2026. In Brazil, Apple has 105 days from late December 2025 to open iOS to alternative app stores and external payments. These aren’t abstract policy footnotes; they change how you acquire users, where you send them, and how much margin you keep.

What changed, exactly—and when?

Here’s the short version, with dates you can put on a wall calendar. Google updated its U.S. program requirements in December 2025 and set January 28, 2026 as the date by which developers linking out to purchases or downloads must enroll, integrate the updated external offers APIs, and follow the new fee and reporting model. You’ll also need to register any external apps you link to, declare links, and report off‑Play transactions within 24 hours.

In Brazil, Apple reached a settlement with CADE in late December 2025 to allow third‑party app stores, external payment options, and in‑app links to external offers, with a 105‑day implementation window. That points to early April 2026 for availability, subject to Apple’s usual review and guardrails. The agreement lasts multiple years, and non‑compliance includes material fines.

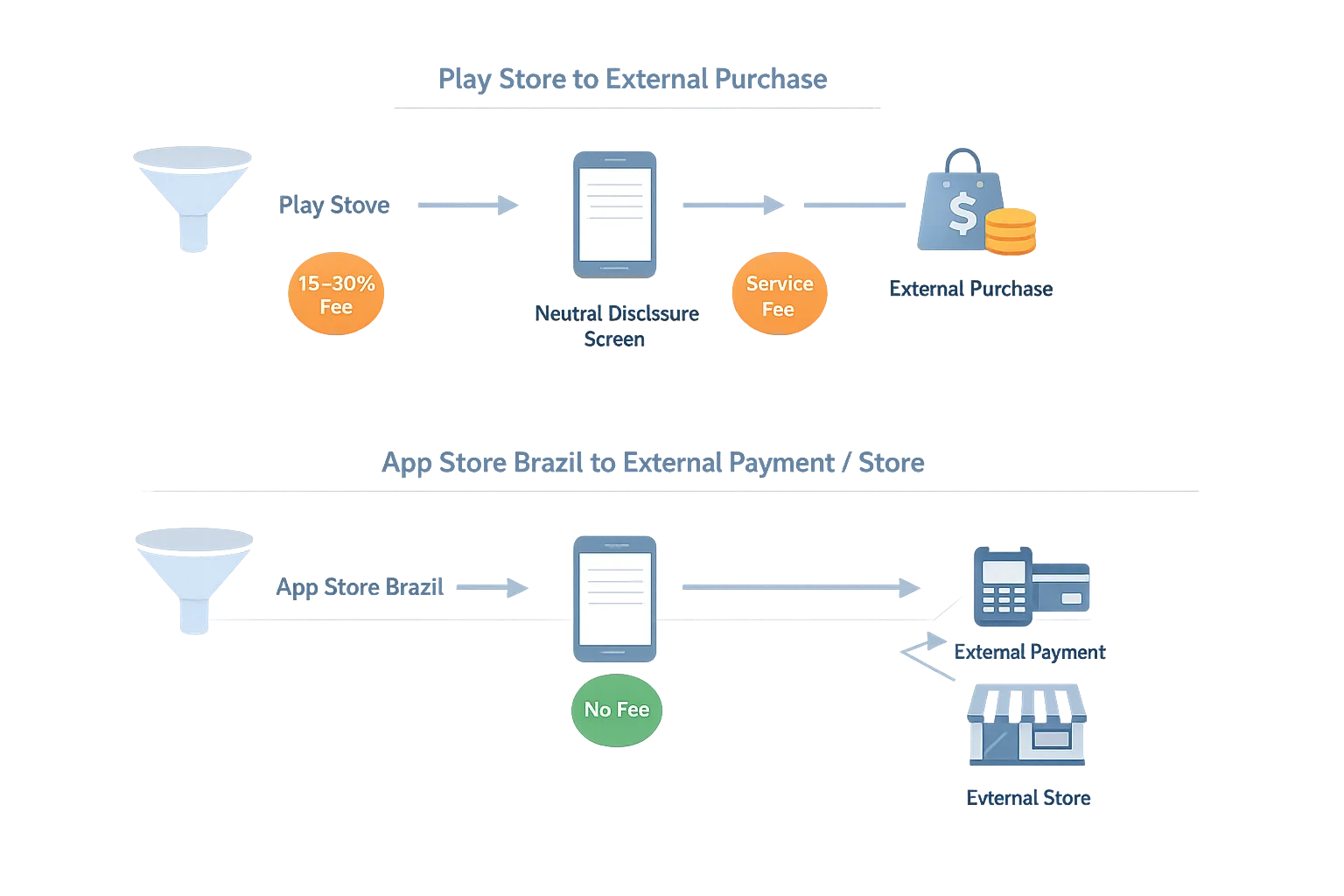

Google Play external link fees: how the money actually works

Let’s get concrete. If your Play Store listing links out, two fee buckets matter when a user acts within Google’s defined windows:

• For links to purchases (external checkout for digital goods), there’s a 3% initial acquisition fee if the user is within six months of a Play‑managed install, plus a required ongoing service fee on every conversion—typically 10% on transactions. Subscriptions often see alternative percentages under Google’s programs; read the fine print before you price changes.

• For links to downloads (sending users to install your app outside Play), there’s a fixed per‑install fee by country and category that applies when the user installs within Google’s attribution window after clicking your external link. U.S. press and developer comms widely peg the current U.S. rates at $2.85 per non‑game app install and $3.65 per game install. Google also expects developers to integrate its APIs for link presentation and server‑side reporting.

Two gotchas I keep seeing in roadmaps: First, teams forget that fees stack. The initial acquisition fee and the ongoing service fee are additive for relevant transactions. Second, marketing tries to dodge fees with vague “learn more” links. If a user still clicks your link and then installs or buys within the window, you’ll be billed. Assume the attribution works as designed.

Do I have to use Google’s APIs if I only add a single external link?

Yes. If you’re participating in the external content links or external offers programs, you must enroll and integrate the updated APIs. Google requires the APIs to render disclosures, capture user intent, and attribute downstream installs and purchases. Skipping them is how you end up non‑compliant and invisible in reporting.

What happens if I don’t enroll by January 28, 2026?

If you intend to keep linking out, you risk policy violations and removal. Even if you pause links, plan the API work now—the review queues won’t be empty in late January, and you’ll need time to validate attribution, billing, and refunds for external transactions.

Apple + Brazil: distribution options are about to multiply

Brazil’s settlement means iOS distribution in that country won’t be single‑channel anymore. Expect the following vectors to open up for users on iPhone in Brazil by early April 2026:

• Alternative app stores that you can distribute through the web or other channels, subject to Apple’s registration and review requirements.

• External payment options alongside Apple’s in‑app purchase system, and in‑app links to external offers—with Apple‑required disclosures and standardized, neutral messaging. Apple will allow informational prompts, but not scare screens or dark patterns that add friction only to alternatives.

Fees in Brazil will depend on the chosen flow—Apple has signaled a defined structure across native IAP, external links, and third‑party stores. Read the implementing guidance closely before you ship changes; your margin assumptions will hinge on those specifics.

Let’s get practical: a 3×3 decision grid for 2026 distribution

Use this grid with your PM, growth, and finance leads. Pick your platform row, then select the column that matches your primary acquisition goal for Q1–Q2.

Rows (platform):

• U.S. Android via Google Play

• Brazil iOS via Apple App Store

• Brazil iOS via third‑party store (once live)

Columns (goal):

• Maximize paid CAC efficiency

• Maximize LTV margin

• Maximize control (own the user, own the funnel)

Suggested plays:

• U.S. Android × CAC efficiency: Keep acquisition inside the Play Store flow for performance ads and ASA‑equivalent placements. Avoid external download links unless you can defend the per‑install fee in your blended CAC. If you link out for purchases, budget the 3% initial plus 10% ongoing service and monitor net ROAS by cohort.

• U.S. Android × LTV margin: If your ARPU is high and purchase activity happens outside six months from Play install, linking to external checkout can recapture margin. Model churn sensitivity; savings disappear if churn rises from added friction.

• U.S. Android × control: Invest in a first‑party web shop and user account system, but still integrate Google’s APIs and reporting. The ability to run lifecycle pricing, bundles, and cross‑product offers justifies the engineering cost for many subscription businesses.

• Brazil iOS × CAC efficiency: Stick with App Store acquisition until third‑party stores stabilize. Use Apple’s approved disclosures for any external payments. Track conversion impacts of messaging changes.

• Brazil iOS × LTV margin: Pilot external payment links for high‑ARPU segments. Keep native IAP as a parallel option to reduce abandonment. Precisely measure gross‑to‑net impacts across SKUs.

• Brazil iOS × control: Test a third‑party store presence for your top game or flagship app once the registration process is clear. Expect some early‑ecosystem friction; design for updates, refunds, and customer support in a non‑App‑Store channel.

Pricing and margin math you should run this week

Scenario A: You link from your U.S. Play Store listing to an external checkout for a $49.99 yearly plan. If the subscriber installed your app from Play less than six months ago, plan for ~3% initial acquisition plus ~10% ongoing service on that conversion. Your net after external processor fees is no longer a pure 2.9% + 30¢ equation—your net margin sits closer to native Play billing than you might expect.

Scenario B: You link from your U.S. Play Store listing to download your APK outside Play. Assume a per‑install fee on completes within the attribution window. If your blended paid CAC is $4.20 and you pay an additional $2.85 per install, you’re at $7.05 before creative, fraud, and support. That can still work at scale if your D30 payer conversion and ARPPU are strong—but don’t fly blind. Model it per cohort.

Scenario C: Brazil iOS, post‑settlement. You add a neutral, Apple‑approved link to pay externally at renewal for power users. If your native IAP take rate was your primary cost driver, externalizing renewals for a portion of the base can lift net margin—assuming disclosure friction doesn’t materially depress conversions. Instrument both paths and cap exposure until you see the lift.

Implementation checklist (engineers + PMs)

On Google Play for U.S. users:

• Enroll the app in the relevant program and pick a service tier.

• Integrate the new external offers APIs to render disclosures and pass required parameters. Verify you can update links dynamically.

• Register any external apps you’ll link to, submit versions, and wait for approval before you point traffic.

• Declare external links in Play Console, even if you plan to manage them dynamically later.

• Implement server‑side reporting for external transactions within 24 hours; reconcile monthly invoices.

• QA the 24‑hour attribution window for external installs, including edge cases like reinstall and device change.

• Update refunds and customer support flows because external purchases won’t be covered by Play support.

On iOS for Brazil:

• Scope alternative store distribution (eligibility, review, updates, rollbacks). Decide which app(s) to pilot.

• Design neutral disclosures and flows for external payments and links that meet Apple’s content and UX requirements.

• Stand up a compliant payments stack (fraud, taxes, receipts, restore purchases, and customer support) and map it to your existing entitlements system.

• Add observability: distinct SKUs or price handles per channel, postback mapping, and renewal source tracking.

• Draft your communications plan for Brazilian users and support teams. Expect early questions about updates, refunds, and safety.

Risks, edge cases, and things likely to break

• Attribution gaps: If your server‑side attribution for external installs is off by even a few percent, the invoice won’t match finance’s expectations. Set up a reconciliation job that surfaces variances daily.

• Link governance: Marketing will want to test copy and placement. Without a feature flag and per‑country gating, you’ll ship a link to a region you haven’t enrolled or registered. Lock it down.

• Subscription restores: Users who move between external and native payments need a seamless entitlement story. If your restore flow assumes a single provider, renewals or downgrades will fail noisily.

• Fraud and chargebacks: Externalizing payments shifts risk to you. Mirror the platform anti‑abuse controls you’ve relied on—device fingerprinting, velocity rules, SCA where applicable, and human review for high‑risk tiers.

• Review queues: December announcements + January deadlines = longer reviews. Budget time; don’t merge on a Friday.

People also ask

Can I avoid per‑install fees by linking to a generic landing page?

No. If a user clicks your link from Play and installs within the attribution window, the fee applies. A vague landing page doesn’t change the billing logic.

Are external purchases always cheaper than native billing?

Not always. By the time you add initial acquisition, ongoing service, processor fees, and increased churn from extra steps, your net may converge with native billing. Run the math on your cohorts, not a spreadsheet average.

Will Apple’s Brazil changes expand to more countries?

Possibly. Apple already made region‑specific changes in the EU and parts of Asia. Brazil’s settlement is bounded to that market, but it’s reasonable to expect similar negotiations elsewhere in 2026.

Governance: who owns what in January

• Product: Define linking rules by market and version. Own the user‑visible disclosures and the A/B testing calendar.

• Engineering: Ship the API integration, attribution, and purchase‑restore logic. Own the monitoring and reconciler.

• Finance: Maintain a weekly dashboard for Play external install fees, external purchase take rates, and refund deltas vs. baseline.

• Legal/Policy: Maintain a live matrix of allowed flows by region and flag upcoming deadlines two sprints in advance.

• Support: Update macros and SLAs for external purchases, including dispute flows and refund eligibility.

A phased 30‑day ship plan

Week 1: Enroll, freeze UX strings, and create feature flags. Draft region‑specific disclosures and submit external app registrations. Stand up server endpoints for API integration.

Week 2: Integrate APIs and instrument analytics. Build the invoice reconciler and cohort calculators (fee exposure, CAC, and net margin). Start review submissions where needed.

Week 3: Soft‑launch links to a 5–10% slice of U.S. traffic and a Brazilian beta cohort. Validate attribution windows, edge cases, and refunds. Tune messaging if conversion drops more than 10% vs. control.

Week 4: Roll out to 50–100% of eligible users. Lock observability dashboards. Publish your internal playbook (what we tested, what worked, escalation paths) and prep the next experiment: bundles, annual pricing tests, or channel‑specific promotions.

What to do next

• Decide where you’ll link out (U.S. Android purchases, U.S. Android downloads, Brazil iOS payments) and where you’ll stay native—by app, by SKU.

• Book the January work: API integration, registrations, and attribution QA. Don’t wait for a last‑minute review slot.

• Model the fee impact on your top three cohorts and adjust pricing or promotions to protect net margin.

• Pilot one Brazil iOS change with a small slice of users in April, then iterate.

If you want a deeper, step‑by‑step breakdown of the Play programs, see our write‑up on Google Play’s new linking fees and what to do now. For Brazil, we’ve published a tactical plan in Apple’s Brazil App Store Changes: A 105‑Day Plan. And if you’re juggling multiple platform shifts into Q1, bookmark App Store Policy Changes: What to Ship by Q1 2026. If you need help prioritizing or shipping, our team’s approach is outlined in what we do for mobile teams.

My take: default to clarity over cleverness

I’ve shipped enough payments and platform integrations to know this: the cheapest path long‑term is the one that’s easiest to explain to a new PM and a new finance manager. Link where it actually lifts LTV, keep native flows where friction adds churn, and make the attribution reliable enough that nobody debates the invoice. It’s not romantic, but it’s how you keep shipping while the policy winds keep shifting.

Comments

Be the first to comment.